My Swing Trading Strategy

I did not take any trades yesterday. The large gap up and subsequent gap fill, was tempting to short, but chose not to pounce on it, because I didn’t want to be squeezed by an afternoon rally (which eventually did happen). I am open to adding some long positions to the portfolio today or even shorting it, if this is a momentary visit at the all-time highs.

Indicators

- Volatility Index (VIX) – A very wild day on the VIX indicator, that despite the rally to new all-time highs, the VIX was up 3% on the day. A very unusual occurrence, and something that gave me pause throughout the day.

- T2108 (% of stocks trading above their 40-day moving average): Only a 9.6% rally yesterday. I actually expected more. So while the market aggressively closes at new all-time highs, only 56% of stocks are trading above their 40-day moving average, which is less than the reading we saw in April.

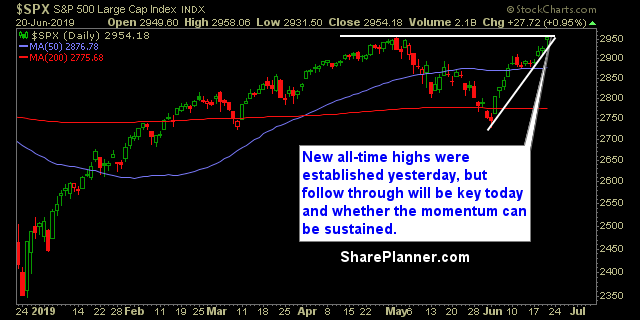

- Moving averages (SPX): SPX currently trading above all of its major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy, as expected, was the day’s big winner and the one sector with the most room to run. However, it has been extremely erratic in its trading behavior of late. Materials also continued its dramatic run off of the June lows. When looking at the sector charts it is only the defensive sectors like Staples, Real Estate, Utilities and Telecom that are printing new all-time highs, while all the growth sectors like Technology, Discretionary and Industrials are well below those all-time highs.

My Market Sentiment

SPX established new all-time highs yesterday along with the Dow Jones Industrial, while the Nasdaq and Russell 2000 remain below theirs. Breadth overall is not impressive, as mentioned above on the indicators, and some warning signs to be considerate of.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 100% Cash