My Swing Trading Strategy

I added a healthcare stock yesterday to the portfolio which is off to a great start so far. I may add another position today, but will need to see this market breakout of its bull flag pattern to the upside.

Indicators

- Volatility Index (VIX) – VIX dropped for the third time in the last four trading sessions, with another minor drop of 0.6% to 15.82. Again the 50-day moving average is holding firm, but has yet to legitimately test it, instead just hovers above it.

- T2108 (% of stocks trading above their 40-day moving average): Inspiring move of 12% yesterday, that closed at its highs of the day. Very bullish gesture, and pushed the reading back into the 40’s to 44%.

- Moving averages (SPX): SPX currently trading above all of its major moving averages. Tested and held the 5-day moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Check out my full and complete sector analysis by clicking here.

My Market Sentiment

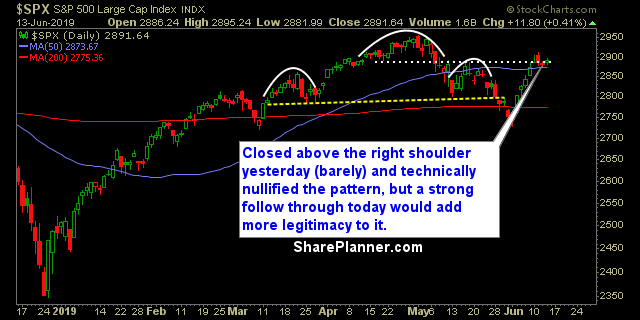

Yesterday’s surge into the close, allowed for the bulls to push price, on a closing basis, above the right shoulder. There is also a bull flag that has formed in the short-term over the last four days, that I expect will break out and push price back near the all-time highs fairly soon.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 40% Long