My Swing Trading Strategy

I have been away for the past week due to the passing of my mother. This will be my first day back at the helm, and ready to get after it. I am still holding two postions in the portfolio, that has benefited greatly from the market bounce last week and yesterday. I will look to add another 1-2 positions to the portfolio if the rally can manage to continue.

Indicators

- Volatility Index (VIX) – $VIX well off its recent highs and still holding the 50-day mvoing average. If that can break and the 5/22 lows can break then we shoudl see a move back into the 13’s once again.

- T2108 (% of stocks trading above their 40-day moving average): Still only at 40% so there is plenty of room to still run on this indicator. A 2.2% move yesterday following six straight days of gains. Small caps haven’t particpated nearly to to the extent that large caps have.

- Moving averages (SPX): SPX currently trading above all of its major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology was the market leader yesterday and one of the major leaders of the market bounce going back to 6/3. Financials have also recovered well, and could be seetting up for setting up for a retest of the May highs. Staples remain the strongest market sector hitting new all-time highs again yesterday. Energy should be viewed with skepticism as it has struggled to bounce with the current market.

My Market Sentiment

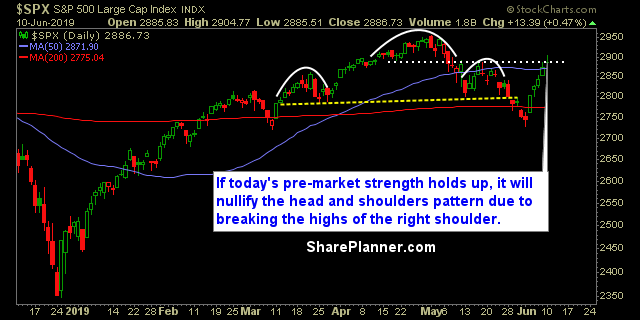

Right shoulder close to being violated and nullifying the current head and shoulders pattern. If that happens, the market sets up for an eventual retest of its all-time highs.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 20% Long