My Swing Trading Strategy

I sold out of my two remaining swing-trades yesterday as their stops were taken out in the early going of trading. I’m 100% cash, but flexible with whatever direction I trade going forward. With all the selling we have seen so far this month, it wouldn’t surprise me to see us rally into month’s end, similar to October 2018.

Indicators

- Volatility Index (VIX) – While a very solid day for the $VIX it still cannot hold its own without giving up a huge chunk of its daily gains, as it managed to do in afternoon trading. Currently sitting at a meager 16.8.

- T2108 (% of stocks trading above their 40-day moving average): An 18% decline yesterday taking the indicator all the way down to 32% and decisively breaking the May lows and the lowest reading since January 7, 2019

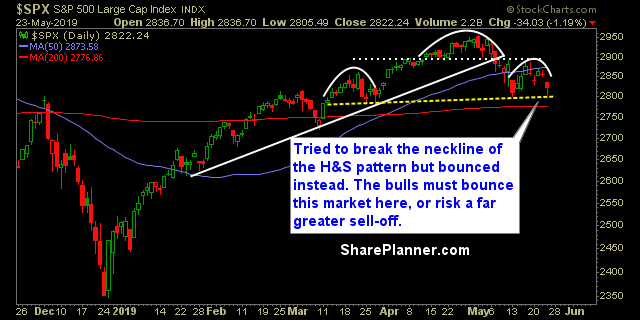

- Moving averages (SPX): Below all the major moving averages except for the 200-day MA, which it isn’t too far away from breaking.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Utilities was the one sector to finish higher on the day, while Energy had its worst day of 2019 due to the massive sell-off in oil. Discretionary has been in the middle of the road with all the recent selling – not too crazy, while Healthcare still exhibits relative strength. Technology could be poised for a bounce here following its 2% sell off yesterday.

My Market Sentiment

Bounced at the end of day yesterday off of the neckline of the head and shoulders pattern. Any sustained bounce must take out the high-end of the right shoulder to nullify the bearish pattern overall.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 100% Cash