My Swing Trading Strategy

I booked gains in Amazon (AMZN) for a +2.7% profit as well as Microsoft (MSFT) for a +3.1% profit. Both solid trades. I am only left with one long position coming into Monday. I will look to see whether the morning weakness holds and if it does, consider adding a short position or two to the portfolio.

Indicators

- Volatility Index (VIX) – Small pop on Friday of 4.4% resulting in a doji candle pattern and the potential for a short-term bottom and pop higher.

- T2108 (% of stocks trading above their 40-day moving average): Lower-lows and lower-highs still in place and it suggests that this market has more room to fall in the coming weeks.

- Moving averages (SPX): Could break back above and hold that break above the 10-day moving average. The 50-day moving average was also broken too. Expect the 5-day MA to get taken out at the open today.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Only Telecom and Utilities traded higher on Friday, while Technology and Energy lagged the entire market. For a full sector analysis, check out my latest post here.

My Market Sentiment

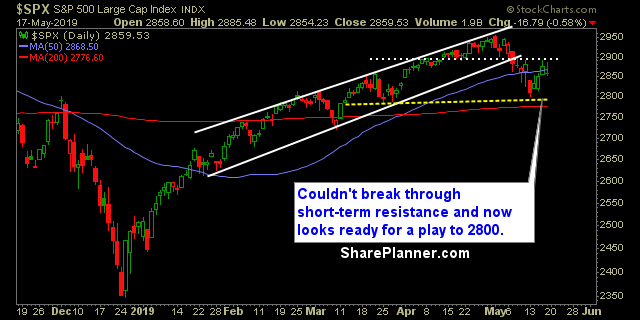

Futures opened up on a positive note Sunday night, but couldn’t hold it into the Monday open as the trade war starts to permeate its way through Tech as well. Watch for a bounce attempt at the open, otherwise, assume that lower prices are likely from here, including a test of the 2800 level, which if broken, would confirm a head and shoulders pattern.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 10% Long