My Swing Trading Strategy

I added one new position yesterday on the market dip, early in the trading session. While the market is pointing towards another lower open, I’m hesitant to do so again, unless there is a very strong and convincing bounce.

Indicators

- Volatility Index (VIX) – VIX popped 20% yesterday, but saw readings at the open that were as high as 18.80. More than half the day’s gains were lost, but still a very strong candle reading for the indicator.

- T2108 (% of stocks trading above their 40-day moving average): Despite a very weak opening, this indicator held strong yesterday and only saw a 3.4% decline with 61% of stocks still trading above their 40-day moving average. Considering how strong the overall market has been of late though, this isn’t an overly impressive number, as I would expect it to be more like 75-80%.

- Moving averages (SPX): Barely lost the 5- and 10-day moving averages, while managing to hold the 20-day MA.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Healthcare led the market dip buying yesterday off of the lows. The recovery in this sector is beginning to look a lot more than a simple dead cat bounce. But instead, one that could challenge its all-time highs in the coming weeks. Materials has been the market’s weakest sector of late as it works on its fifth straight week of declines. Similar action out of Energy as it is doing the same.

My Market Sentiment

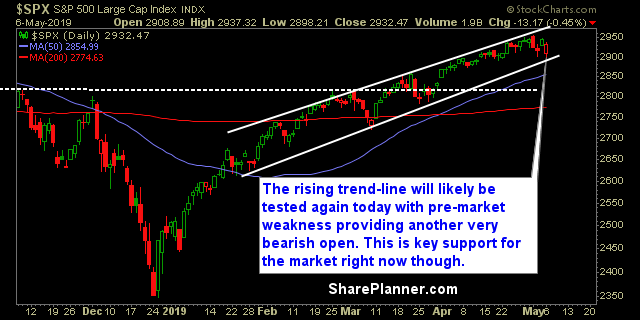

Another major gap down with trade fears back on the table. The rising trend-line could be tested, and for the bulls to not lose its grip on this market, it needs to hold, otherwise a much bigger pullback becomes more likely.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 40% Long