My Swing Trading Strategy

I’m not coming into today with a lot of long exposure. I have three positions to contend with and will raise the stops where possible. Today’s extreme gap down will make getting short without some kind of dead cat bounce first, a difficult proposition. May be a day to just manage existing trades and stand to the side on any new trades while the market decides what it ultimately wants to do.

Indicators

- Volatility Index (VIX) – Following an 11% decline on Friday, expect a massive increase today of at least 10-20%.

- T2108 (% of stocks trading above their 40-day moving average): A 14% increase on Friday that will be easily wiped out today. It is very possible we see a move below 50%, which would certainly be a negative gesture for this market going forward.

- Moving averages (SPX): While price action managed to recapture the 5 and 10-day moving averages, expect all that to be given back up at the open as well as the 20-day MA.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

All your sectors rallied on Friday, while Materials and Industrials led the way. Expect for today to be a day where any sector rotation will favor the defensive stocks like Utilities, Staples and Real Estate.

My Market Sentiment

This gap down following the Trump tweets over the weekend, has created hard reversal following Friday’s rally. The potential is always there for a dip buy, but caution will certainly be needed in that your first priority has to be to manage the risk on your existing positions, while being patient to find the right opportunity to buy the weakness or flip to the short side on a dead cat bounce.

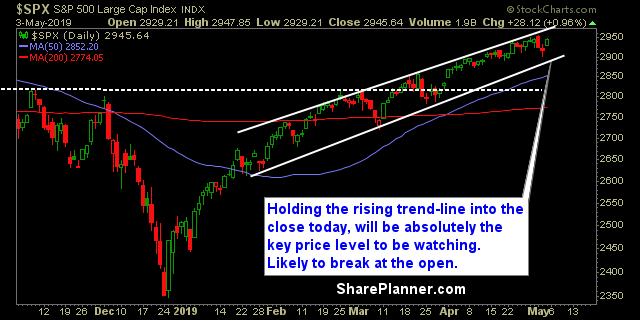

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 30% Long