My Swing Trading Strategy

I closed out Two trades yesterday, One for a profit and the other for a loss. yesterday’s whipsaw price action took created a little havoc for traders, however, I am coming into today with both long and short exposure, but don’t expect the short exposure to last long into the market open. I’ll also look to add a new trade to the long side today.

Indicators

- Volatility Index (VIX) – VIX blew up early on yesterday and managed to lose all of its gains and finish red on the day. Strong potential again for another push towards 12.

- T2108 (% of stocks trading above their 40-day moving average): Third day in a row that the indicator has dropped, with only 55% of stocks trading above their 40-day moving average. This is a resounding divergence considering the market is trading near its all-time highs.

- Moving averages (SPX): Couldn’t hold the break above the 10-day moving average, but managed to buy the dip at the 20-day. Expect for a challenge of the 5 and 10-day again today.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Healthcare saw a resumption in buying yesterday and was the one sector that was noticeably higher on the day. Real Estate looks ready for profit taking, while Financials still consolidating well at the rally highs. Technology has consolidated for the past seven trading sessions, but may be ready to break out today.

My Market Sentiment

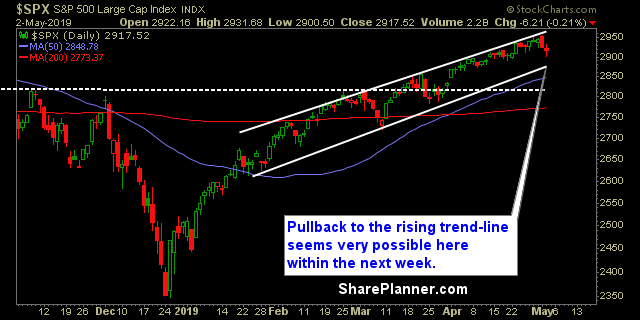

Yesterday saw a good bit of follow through to Wednesday’s FOMC sell-off. However. The market appears ready to buy the dip and push price back up. The bottom channel of the rising trend-line should be viewed as primary support moving forward.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 20% Long, 10% Short.