My Swing Trading Strategy

I added one additional trade to my portfolio yesterday, while tightening the stop on existing trades. I may add an additional trade today, but the market will have to be overwhelmingly bullish, and that doesn’t necessarily seem to be the case so far this morning.

Indicators

- Volatility Index (VIX) – A three percent pop and a close near the highs of the day. Somewhat surprising considering the slight rise in SPX yesterday. The 50-day moving average could very well provide some resistance for it today as it has done in the past.

- T2108 (% of stocks trading above their 40-day moving average): Barely a rise yesterday and now sitting at 63%. Despite hitting new all-time highs yesterday in the stock market, this indicator couldn’t even break last week’s highs.

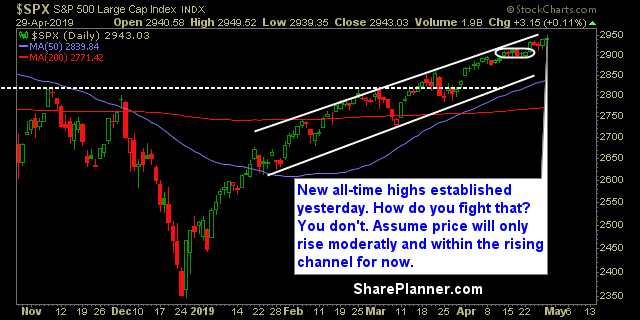

- Moving averages (SPX): Price is trading above all the major moving averages now.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Financials continues to be the market darling, and the main reason why the market as a whole was even able to crack a profit. Technology will be under pressure from Google’s (GOOGL) earnings that disappointed the Street. Staples continues its nonstop rise. If the Healthcare bounce is just a dead cat bounce, today would be the likely time and place for it to end.

My Market Sentiment

New all-time highs. If you are still of the theory that this market is double topping (and it could), then the turn lower, pretty much needs to start now. Otherwise, it will be null and void with a continued market rise.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 50% Long.