My Swing Trading Strategy

I sold Jacobs Engineering (JEC) for a +3% profit yesterday but also took a -1.5% loss in Ralph Lauren (RL). The reward/risk was textbook between the two of 2:1. I added one new swing-trade yesterday to my portfolio and won’t rule out another today. However, my confidence in that happening is low, as the market continues to languish during trading hours.

Indicators

- Volatility Index (VIX) – A big massive doji candle on the VIX, closing out at 13.25 and 0.8% higher on the day. But you guessed it, well off its highs of the day. However, it did manage to close above the 20-day moving average for only the second time this month. Last time that happened, we we saw a significant rally thereafter.

- T2108 (% of stocks trading above their 40-day moving average): Still horrible breadth on NYSE as well as a 9% decline on the T2108. Still a potential bearish divergence here.

- Moving averages (SPX): Price is trading above all the major moving averages now.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Healthcare continues to bounce this week following the horrific sell-off last week. No surprise it is bouncing, but it is hard to believe it is anything more than a dead cat bounce so far. Technology is likely to be under pressure today as Intel (INTC) disappointed on their earnings report. Double top in Telecom popping up to be concerned with here. Energy has given back its recent gains this week, and the breakout that was unfolding back on Monday.

My Market Sentiment

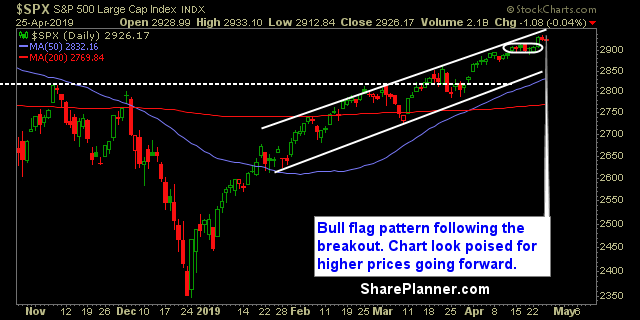

It was another 1 point day – yes, this is becoming quite regularly these days. SPX though still looks solid, even after having its first multi-day decline this month. It is more like a bull flag following Tuesday’s breakout.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 40% Long.