My Swing Trading Strategy

Two new positions were added yesterday, while continuing to hold on to the existing trades. I’ll entertain adding another today, if yesterday’s momentum can be sustained.

Indicators

- Volatility Index (VIX) – Dropped 1.1% down to 12.28, bouncing off the lows in the final hour of trading. I don’t expect big moves to the downside from here.

- T2108 (% of stocks trading above their 40-day moving average): Breadth was the best I have seen in a long time with the day trading a 3:1 edge for advancing issues. On the T2108, a big spike of 13.4% to 64%.

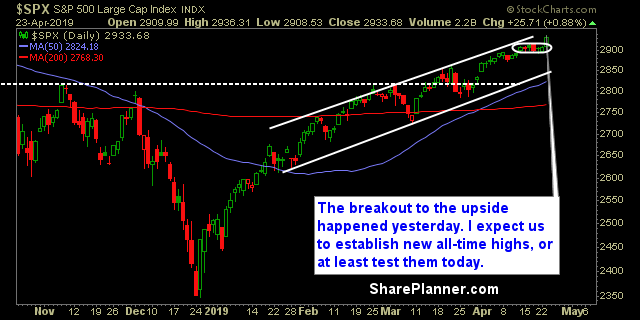

- Moving averages (SPX): Price is trading above all the major moving averages now.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Heathcare had a much needed bounce of 1.7% yesterday and helped the rally sustain its gains. Five sectors matched or beat the market yesterday. Technology also soared to new all-time highs as did Discretionary for the first time since the Q4 sell-off. Energy, Materials and Telcom didn’t see any action.

My Market Sentiment

SPX improved its volume levels from the ridiculously low volume levels the day before. Huge breakout of the five-day trading range. Look for a test of the all-time highs today.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 50% Long.