My Swing Trading Strategy

I booked profits in Schlumberger (SLB) for +3.6% yesterday while also adding another position to the portfolio. I’ll look to add more today if this market can hold the morning rally and show a willingness to build upon it.

Indicators

- Volatility Index (VIX) – Finished only 1% lower, but did manage to trade, intraday, below 12 but not hold it into the close.

- T2108 (% of stocks trading above their 40-day moving average): Some more divergence in this indicator to the downside, as breadth continues to lack, and has been negative on the indicator five of other last seven days despite SPX rising five of the last seven days – not normal!

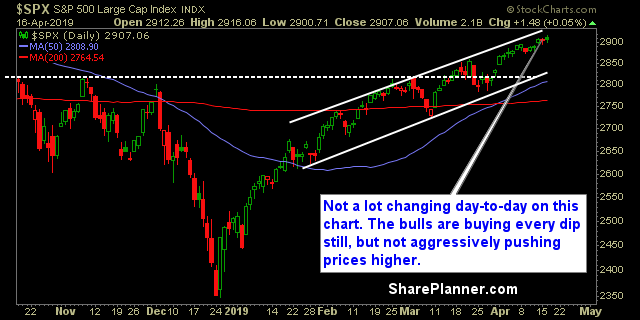

- Moving averages (SPX): Currently trading above all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Financials continue to push higher of late, and with the major bank players having already released their earnings, you could see a lot more interest come into this sector. Discretionary continues to be one of the strongest sectors of the past two months, and should always warrant some exposure, as is the case with technology. Energy names will start reporting soon, and you’ll want to be careful not to walk into any minefields there. Materials bull flagging for possible higher prices.

My Market Sentiment

I’m bullish still on this market and until a sell-off can be sustained on just an intraday basis, there is very little reason to be adding short positions. The volume remains very weak, and I don’t expect any big moves out of this market at this moment, as much of the daily moves is happening in overnight trading.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 50% Long.