My Swing Trading Strategy

One new trade was added on Friday, but I stayed put the rest of the day. I sold my position in Netflix (NFLX) for a +1.1% profit. Today the market is opening lower, so it will be important that any weakness can be contained and kept from seeping lower.

Indicators

- Volatility Index (VIX) – Dropped for the 8th time in the last 10 sessions and now below 13. March’s lows held, but could see further tests in the days ahead.

- T2108 (% of stocks trading above their 40-day moving average): Another solid increase of 7% taking the indicator up to 68%. Bearish divergence is close to being wiped out on this indicator.

- Moving averages (SPX): Trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy is starting to take off, and will have a chance today to break its 200-day moving average. Healthcare consolidating at the high end of its consolidation and seeing strength in biotech of late. Utilities appears ready for a bounce after a light volume pullback.

My Market Sentiment

Likely to see the market held back some today by weakness from Boeing’s (BA) production cut. The market is up seven straight days and due for a pullback of some kind. However, with the low volume activity seen in the market of late, I don’t expect it to be much.

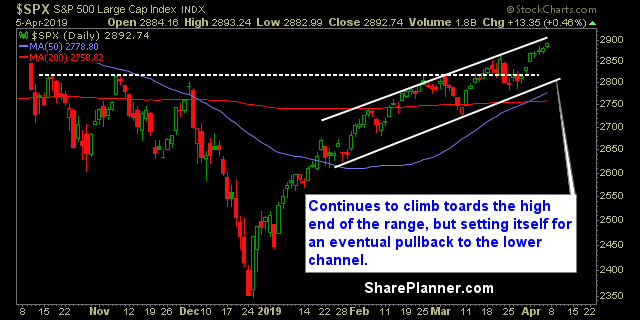

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 30% Long.