My Swing Trading Strategy

I sold my position yesterday in SPXU for a +1.5%. Not as much as I would have liked from the trade, but I also found it hard to justify holding it another day without the market showing a strong propensity to want to go lower. I may jump back in, if the market conditions warrant a sell-off. Otherwise, I will start looking for potential bounce candidates.

Indicators

- Volatility Index (VIX) – VIX managed to rally 3% yesterday, but well off the highs of the day, as the early weakness quickly reversed into an afternoon rally. It may be ready to bounce, but the indicator is likely to stay muted until some news hits on China, or first quarter earnings kicks off.

- T2108 (% of stocks trading above their 40-day moving average): A 4% decline yesterday, to take the indicator back below 50%. Still flashing a rollover, but the moves are getting smaller.

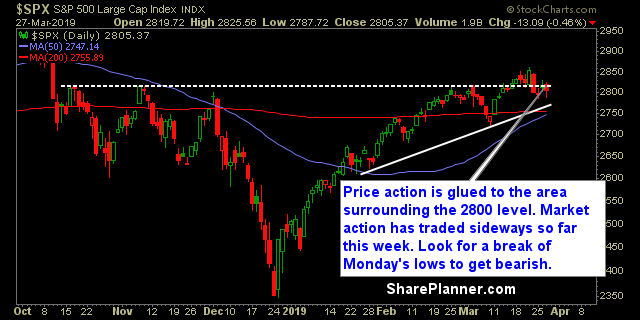

- Moving averages (SPX): Managing to hold the 20-day moving average but unable to break back above the 5 and 10-day MA’s.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Led by strength in Boeing (BA), Industrials managed to be the only sector to finish in positive territory yesterday. Technology leading to the downside with a much bigger pullback than the broader market. But over the last seven trading sessions, Financials are by far the weakest and should be avoided. Much of the market this week have simply been trading sideways.

My Market Sentiment

Plenty of indecision in this stock market. I would have thought the bears would have been able to drive this market lower following Friday’s steep sell-off, but the market has managed to trade sideways in a very unexciting way. Patience is key here, and to not force trades that aren’t there.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 100% Cash.