My Swing Trading Strategy

I added another long position yesterday and will look to increase the value of my current positions before adding anything new to the portfolio. I don’t see myself adding any more than one new position today.

Indicators

- Volatility Index (VIX) – Traded higher 1.7% yesterday, but was due for a bounce of any kind. Still compressed and pointing lower.

- T2108 (% of stocks trading above their 40-day moving average): Looking to reverse the bearishness of last week, with a 3.5% rally yesterday. Still only a 64% reading and well below recent highs.

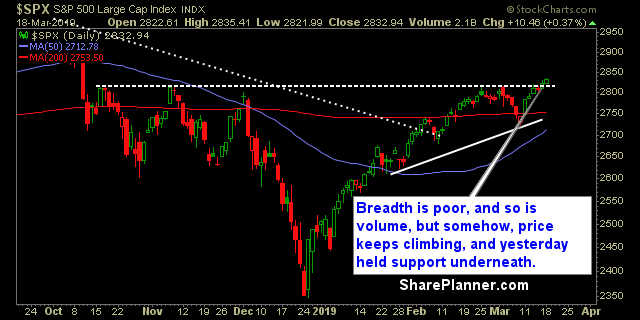

- Moving averages (SPX): Currently trading above all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy with a huge day yesterday, emerging out of an inverse head and shoulders pattern, and the same can be said with the Financials too. Very good chance we see a test of all-time highs in Technology in the very near future.

My Market Sentiment

Volume and trading patterns of SPX right now shows a lot of similarities to what you typically see during the summer time. Low volume and not the greatest breadth. Nonetheless the market keeps pushing higher, and I’d suspect that it will reach new all-time highs in the near future.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 40% Long.