My Swing Trading Strategy

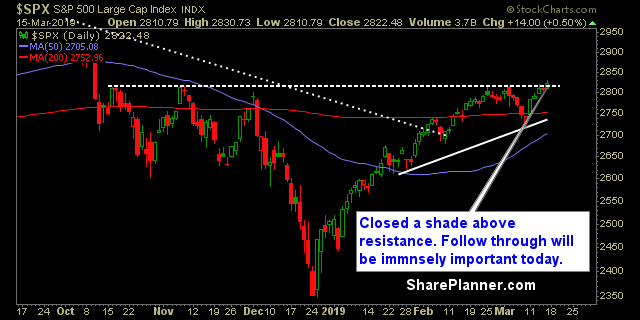

I did not add any new positions on Friday, but now with SPX having closed above key resistance, opens me up to additional long positions.

Indicators

- Volatility Index (VIX) – Broke support at the 13.39 area, and dropped into the 12’s with Friday’s move. Good chance we could see a sustained move lower, and possibly the 11’s.

- T2108 (% of stocks trading above their 40-day moving average): Breadth was poor on Friday as the indicator actually dropped 1.4%, creating the potential for a continued bearish divergence.

- Moving averages (SPX): Currently trading above all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Telecom has been, by far, the strongest sector over the past week. Also interesting is how Staples showed similar strength on Friday, which, coupled with breadth issues, could be a sign that the bulls are trying to rotate their money into safer sectors. Technology poised to test its all-time highs for the first time since August of last year. Utilities continue to print new all-time highs.

My Market Sentiment

The bulls broke through resistance, but barely. However, it won’t take much for price to drift back below the breakout level, and so follow through becomes very important to clearly establish the broken resistance as support underneath.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 30% Long.