My Swing Trading Strategy

I added two new long positions yesterday to my portfolio – and both are off to good starts. I’ll look to add another long position today as well, and I have it in the back of my mind to be ready if this market decides to reverse and make life difficult for traders.

Indicators

- Volatility Index (VIX) – A hard follow through to the downside of almost 11%. Volatility is dropping and so is market volume. Could see a push into the 12’s from here.

- T2108 (% of stocks trading above their 40-day moving average): A very big pop that th indicator hasn’t seen since early January. A rally of 16% yesterday, sent the indicator back up to 63% with more room to still rally on.

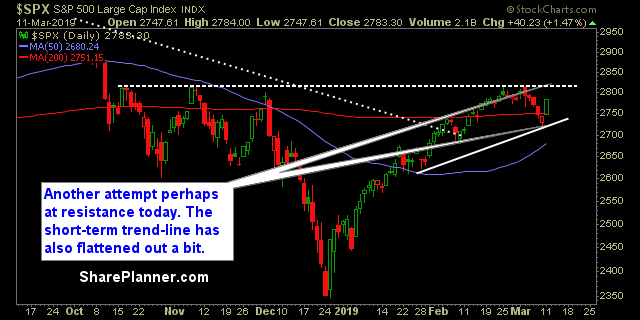

- Moving averages (SPX): As crazy as it sounds, price retook all of the major indicators yesterday, including the 200-day. Very strong move.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology was the market leader and that is exactly what you want to see out of a market rally. Energy was right behind it, but I don’t trust that sector enough to want to trade it at all. The chart isn’t all that healthy either. Industrials did quite well considering the price action of Boeing (BA). I would be okay venturing into some industrial names today. Healthcare also looks like a good sector to buy on the dip as well.

My Market Sentiment

I think the bias should be to the long side, considering the extent of yesterday’s bounce and the willingness to possibly follow through this morning. Resistance is lurking overhead, so if price is rejected there again, then start booking some profits.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 20% Long.