My Swing Trading Strategy

I closed out my long position in SPXU (3:1 inverse of SPX return) for a +4.0% profit yesterday. I honestly love the days where I am shorting the market or profiting from a market that sold off. I’m 100% cash now, and I’m looking to play a potential bounce play today.

Indicators

- Volatility Index (VIX) – Up for the fourth straight day, but only +5.4% yesterday, as it gave back a good chunk of it in the final hour of trading and formed a doji-like candle pattern. Despite the market being down seven of the last eight trading sessions, VIX hasn’t climbed as much as you’d think, which makes me suspicious of the ability of this sell-off continuing.

- T2108 (% of stocks trading above their 40-day moving average): Heavy slide on this indicator though, with a 10% decline, has it providing a 57% reading now. Overbought market readings have definitely been worked off.

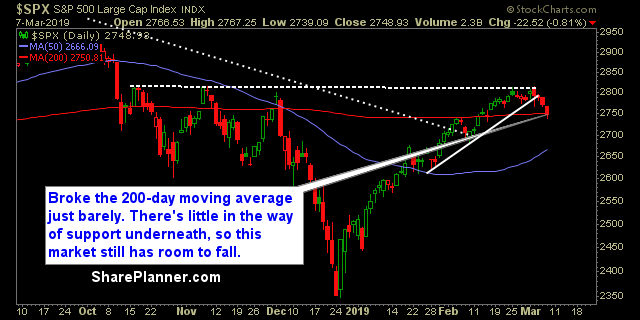

- Moving averages (SPX): Broke the 20-day moving average as well as the 200-day moving average, though the latter was just barely.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

If you are looking for a “safe” sector, Utilities would be your guy. Bull flagging at the all-time highs here, and looking to push higher. Telecom is due for a bounce after selling off nine straight days. It may be only for a day or two, but some relief is needed in that sector. Healthcare continues to take a sharp nose dive, while Financials, Discretionary and Technology continue to rollover as well. If the market bounces today, focus on Technology and Discretionary.

My Market Sentiment

The bulls are kind of in ‘no-man’s land’ here, with very little support underneath, which is due to the dramatic rise that was seen back in the beginning of the year. So there certainly is plenty of room to fall further, however, there is a strong ‘buy-the-dip’ mentality in this market still, and we may see that come into play today.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 100% Cash.