My Swing Trading Strategy

Booked profits in Spotify (SPOT) yesterday for a +2.9% profit. I was stopped out of two other trades that I wasn’t crazy about, while adding one short position, which I still have. I’ll look to add more exposure either long or short, depending on how the market behaves.

Indicators

- Volatility Index (VIX) – VIX finally closed above the 20-day moving average, after numerous attempts over the last two months to do so. A 6.8% pop yesterday, heightens volatility, with the potential for more.

- T2108 (% of stocks trading above their 40-day moving average): One of the biggest declines since the December 26th bottom. A 10% decline that takes the T2108 down to 63% and the lowest reading since January 16th.

- Moving averages (SPX): Very close to a test of the 20-day moving average. Hard to say whether it will bounce there, as it has not been tested much of late.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Healthcare continues to take an absolute beating and showing clear signs of a breakdown. Utilities and Staples held up well amidst the selling, which is what you’d expect. Telecom continues to get rocked with its 8th straight day of selling. Industrials also showing the potential for rolling over here. Discretionary and Technology are consolidating at their highs, and could be poised for more upside.

My Market Sentiment

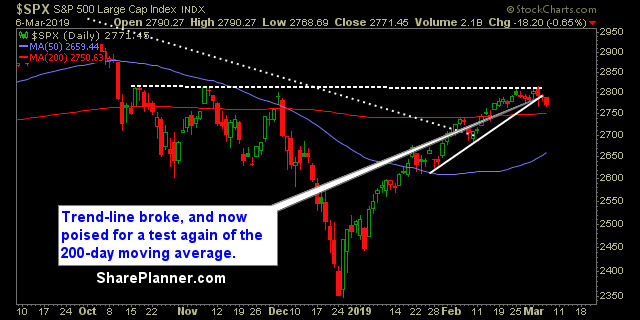

The bulls failed to break through key resistance. and has dropped six out of the last seven trading sessions. I expect we’ll see a test of the 20-day moving average and possibly the 200-day MA as well, with the latter no doubt being a critical support level.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 10% Short.