My Swing Trading Approach

I closed Square (SQ) yesterday for a +3.1% profit. I also added one additional play from the energy sector. I will consider one additional long position today, but the sketchy price action of late, may have me on the sidelines today.

Indicators

- Volatility Index (VIX) – Intrday price action on SPX was all over the map on Friday, but the VIX was undeterred selling off 8.2% for a reading of 13.57.

- T2108 (% of stocks trading above their 40-day moving average): Despite the market rallying on Friday, breadth was awful, as it barely finished higher to the tune of 0.2%.

- Moving averages (SPX): Back above the 5-day and all other moving averages. The 10-day moving average continues to provide bounce support.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Healthcare was the primary market driver Friday, leading the way to the tune of 1.7%. Eli Lilly (LLY) continues to provide huge amounts of volume and strength for that sector. Energy still working that bull flag to the upside, but yet to confirm. Technology spent last week consolidating at its highs as did Discretionary. Materials showing a little rollover action in recent days.

My Market Sentiment

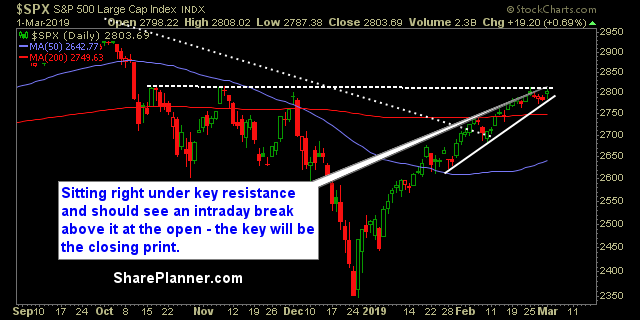

Key resistance today in play and should see a break above it at the open this morning. All that matters though is whether it can close above key resistance, and flip it into support.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 40% Long.