My Swing Trading Approach

I bought Square (SQ) on the dip yesterday in the Swing-Trading Splash Zone and currently sitting on +5.7% in profits. I will consider adding one additional long position today.

Indicators

- Volatility Index (VIX) – A small upward move of 0.5% yesterday. Again the 20-day moving average was tested, and price was rejected.

- T2108 (% of stocks trading above their 40-day moving average): One of the bigger declines that we have seen in quite some time. In the grand scheme of things it was small, but over the course of this rally, a 4.1% sell-off on the T2108 seemed rather large and is currently down six of the last seven trading sessions with a reading of 77%.

- Moving averages (SPX): Broke the 5-day moving average yesterday, but tested and held the 10-day MA.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Very defensive day from the market yesterday as Staples, Real Estate and Utilities were the top three sectors and the only three to finish in the green. Financials coiling at their recent highs and could see a pop here.

My Market Sentiment

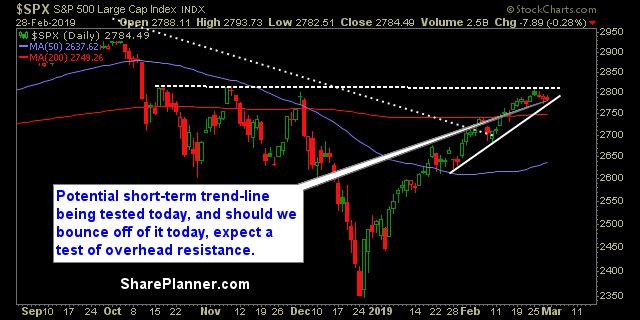

Stocks are looking strong in the pre-market here and likely to bounce into overhead resistance. Needs to break through and claim it as support going forward. Bull flag pattern over the last four days of trading. The chart remains very bullish.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 40% Long.