My Swing Trading Approach

I did not sell any of my positions ahead of the bell on Friday, and I added one more long as well. I may add one additional trade to the portfolio today. I do plan to further tighten my stops on existing trades as well.

Indicators

- Volatility Index (VIX) – VIX is back to levels last seen prior to the Oct-Dec sell-off. Good chance that we push into the 10-12 range, if the rally persists.

- T2108 (% of stocks trading above their 40-day moving average): A pop on Friday, helped the indicator push back toward its recent highs. Expect small movements to the upside on this indicator going forward.

- Moving averages (SPX): Currently trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Staples saw a heavy dose of selling on Friday, as traders were leaving it for Technology and Discretionary. Financials continues to be a hit or miss. On Friday, it finished in positive territory, but it lagged the overall market direction.

My Market Sentiment

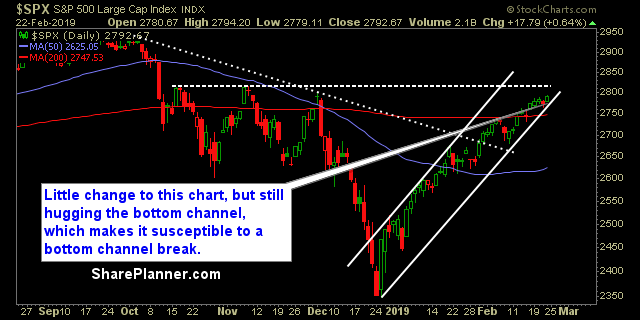

Rising channel still intact, on above average volume Friday. The highs from November/December bounces are likely to be tested in the near future. Price action continues to hover around the 5-day moving average.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 40% Long.