My Swing Trading Approach

I closed out two positions yesterday: Netflix (NFLX) for a +1.5% profit and Square (SQ) for a +1.1% profit. Nothing all that exciting, but I was looking to curb some risk as the afternoon trading session was on shaky ground. May end up getting back in them in the not-so-distant future if price action can hold up in this market.

Indicators

- Volatility Index (VIX) – Volatility continues to drop hard, this time another 5.8% down to 14.02. The market isn’t looking at a lot of headline risk right now, even with news of a potential Mueller report next week.

- T2108 (% of stocks trading above their 40-day moving average): Remained flat on the day, and I suspect you’ll see a lot more days like that in the near future as long as the market continues to consolidate or push higher.

- Moving averages (SPX): Currently trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Materials continues to run parabolicly higher over the last seven trading sessions and it is doing so on increasing volume. Financials continues to catch a bid as well. Healthcare recovered off the lows of the day, and while the daily chart still looks fine, the sectors has still been lagging the market over the last two trading sessions.

My Market Sentiment

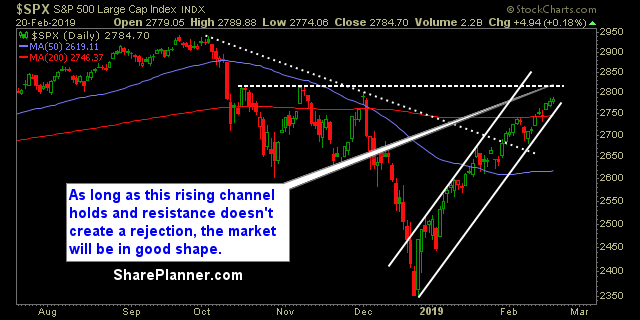

The rising channel remains firmly in place. Resistance overhead could certainly become an issue. Those are the two main areas that need to be emphasized right now.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 30% Long.