My Swing Trading Approach

I closed my sole short position at the market open yesterday and added two additional long positions. I’m open to adding another long position today, as long as the market holds up, and doesn’t attempt to give back yesterday’s gains.

Indicators

- Volatility Index (VIX) – Small drop yesterday considering the overall market’s push higher. VIX sitting 3.4% lower at 15.43.

- T2108 (% of stocks trading above their 40-day moving average): A 4% rally yesterday took the indicator back up to 84% and remaining strong despite extreme overbought conditions.

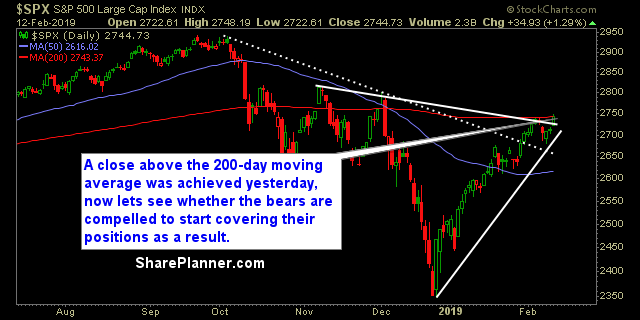

- Moving averages (SPX): Big move yesterday as SPX managed to close a shade above the 200-day moving average for the first time since December 3rd of last year.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

What else but Technology would lead the way? It was up a huge 1.6% yesterday and setting up for more today. Energy and Materials both rebounded, but Industrials still remains a better option at this point as is Healthcare.

My Market Sentiment

An ideal day for the bulls yesterday as it managed to break through the 200-day moving average and close there as well. At this point, the recovery has gone well beyond a dead cat bounce and is now setting up for a test of the December and then November highs.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 30% Long.