My Swing Trading Approach

I used yesterday to take advantage of the strength in Square (SQ) and book profits for a +4.5 profit. I also added another trade to the portfolio yesterday, and will look to do the same, as long as the market can hold up today. But any additional trades at this point have to be measured. You can’t dog pile on this market at this stage, when it has been up 21 of the last 28 days because, at some point there will be profit taking and you don’t want to be a bag holder as a result.

Indicators

- Volatility Index (VIX) – Down for a fifth straight day, the indicator closed at 15.57, and over the past couple of weeks there has been a huge reduction in price swings.

- T2108 (% of stocks trading above their 40-day moving average): This reading is becoming quite absurd. We are now sitting on an 86% reading which signifies an extremely overbought market.

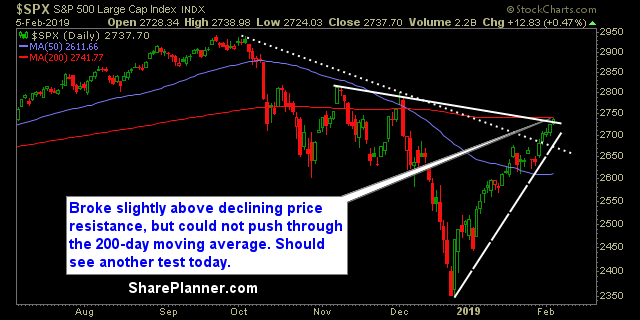

- Moving averages (SPX): We came close to testing the 200-day moving average yesterday, but expect it today, as price is only a few points away from it now.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

An ideal setup of Discretionary, Technology and Industrials leading the market higher yesterday, but in the midst of all this, Financials continues its struggle of late to catch a bid higher. Continue to focus on the market leaders that are providing consistent direction for the market, particularly Technology.

My Market Sentiment

That test of the 200-day moving average that I have been speaking of for a while now, is likely to happen today, and right near the opening bell. There is the potential for a sharp rejection in price at this level, as some traders will certainly be looking to get short on this market once again. So far the market has shown zero willingness to get bearish here, but each day is a new day, and you have to be prepared for it, even if it doesn’t seem likely at the current moment.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 20% Long.