My Swing Trading Approach

I added one additional long position to the portfolio yesterday. I may add another today, but the market will have to show me it is intent on rallying again and none of this meandering like we saw following yesterday’s gap higher.

Indicators

- Volatility Index (VIX) – Closed right on the 200-day moving average yesterday, and its lowest close since December 3rd. Volatility continues to come off the board as traders continue to buy the dip.

- T2108 (% of stocks trading above their 40-day moving average): This indicator keeps progressively getting stronger, with a close yesterday at 83%.

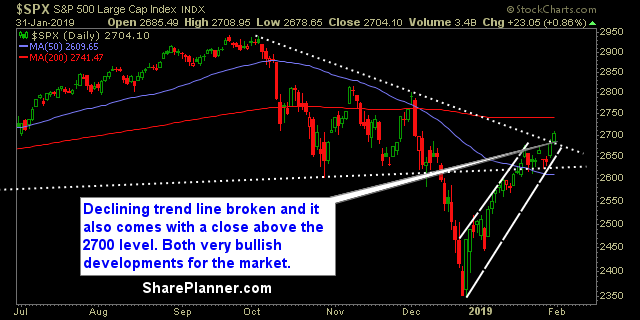

- Moving averages (SPX): Strong possibility we see a test of the 200-day moving average in the coming days. Only 37 points away.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

The defensive stocks saw plenty of cash flowing into them: Telecom, Utilities and Staples. Financials continues to to lag the overall market price action and probably should be avoided at this point. Energy is still an interesting play with this week’s breakout of consolidation. Technology broke back above the 200-day moving average since October of last year.

My Market Sentiment

The declining trend-line off of the October highs was broken yesterday, leaving little doubt to intent. It is a new month, and this time last year we saw a major decline start following an impressive January start. While the technicals are favorable for this market, it is also very overbought and overextended at the current levels.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 30% Long.