My Swing Trading Approach

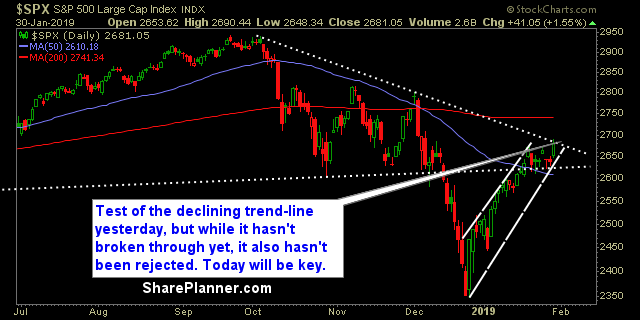

I added two new long swing-trades to the portfolio yesterday. However, I will be a little more reserved about how many new longs I add today. The market will have to prove it wants wants to break the declining downtrend off of the October highs.

Indicators

- Volatility Index (VIX) – Looking at another test of the 200-day moving average. Declined 7.7% yesterday to settle at 17.66. Still the 200-day MA has not been broken since October of last year.

- T2108 (% of stocks trading above their 40-day moving average): An 81% reading is quite significant. So high that it hasn’t been seen since 4/27/16.

- Moving averages (SPX): Broke through the 5-day moving average. Only the 200-day MA is left.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology was the market leader by a long shot but is coming up on its own 200-day moving average here that could pose some issues. Energy is breaking out of its consolidation and may be worth playing here. Healthcare has a bull flag that it is working its way out of too.

My Market Sentiment

The big names like Boeing (BA), Apple (AAPL) and Facebook (FB) continue to impress with their earnings reports, and has kept the market from giving up its most recent gains. The resiliency of the market since the December lows has been overly impressive. I’m concerned though by how exuberant this market has become and the potential for a sell-off in February.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 20% Long.