My Swing Trading Approach

I am coming into today 100% cash, but also very skeptical about getting long on this market as most trading sessions where there is a strong earnings report that comes out, usually sees price fade throughout the trading session. I closed out my position in Bank of America (BAC) yesterday for a small profit.

Indicators

- Volatility Index (VIX) – Very little movement out of this index over the past couple of weeks. It has settled into place just north of the 200-day moving average, similar to the consolidation that was seen in late September and early October.

- T2108 (% of stocks trading above their 40-day moving average): Pushed higher yet again yesterday and remains at multi-year highs of 76%. Price action out of the market is struggling to find a lot of movement higher at the moment until we can see some kind of pullback reflected in this indicator.

- Moving averages (SPX): Price action is stuck below the 5-day and above the 10-day moving average at the moment and continues a second day of tight consoldiation.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology and Discretionary struggled mightily yesterday as the market traded flat yesterday. Buoyed with Apple (AAPL) earnings these two sectors should lead the way higher today.

My Market Sentiment

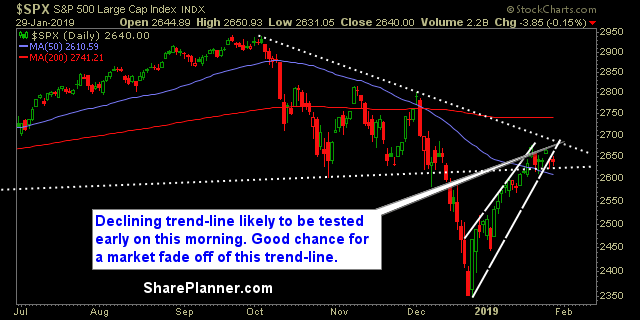

Apple (AAPL) earnings yesterday has catapulted the market higher in the premarket. However, be concerned with the declining trend-line as shown below as the market may stall at, not to mention the market tends to fade strong earnings reports from the biggest names.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 100% Cash.