My Swing Trading Approach

I added one additional position on Friday, and will look to add more to the long side today, should the market show a willingness to reverse the morning weakness. At the very least, I will also be tightening my stop losses and protecting profits.

Indicators

- Volatility Index (VIX) – Another massive drop on the VIX with a 7.8% drop and now back down to 17.42 – the lowest close since 12/3.

- T2108 (% of stocks trading above their 40-day moving average): A 9% rally taking it back up to 76% and the highest close since 10/5/17. In one month it has risen from 3% all the way up to its current reading. That is as steep of a rise as it gets.

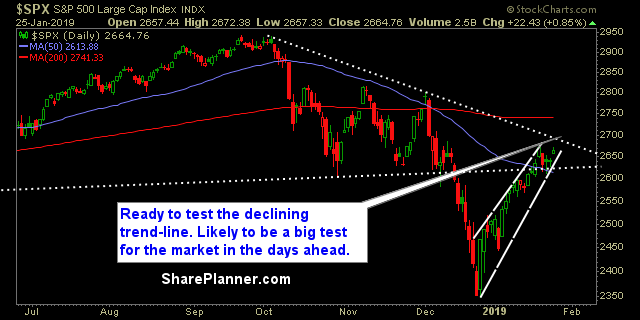

- Moving averages (SPX): Reclaimed the 5-day moving average, and appears on course for an eventual test of the 200-day moving average.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Basic Materials led the way with incredible strength, while Technology was right behind. Energy continues to consolidate in price, but showing signs that it may be ready to continue the trend higher after consolidating for much of this month. Healthcare has recently stalled out, but I’m looking for a possible bull flag break out here in the coming days, if the market doesn’t have a breakdown of its own today.

My Market Sentiment

Last week marked the first trading week of the last five that finished in the red, despite finishing higher in three of the last four trading sessions. Bull flag pattern over the past week, saw a break out it on Friday. Now it becomes critical that the bulls follow through and doesn’t allow for a break below last week’s lows.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 30% Long.