My Swing Trading Approach

I booked profits in Nike (NKE) at $80.47 yesterday for a +2.4% profit. I added another long position yesterday as well and will look to add more today, if this market can pull out of the bull flag that it is trying to form here.

Indicators

- Volatility Index (VIX) – Crashed and burned yesterday after popping higher and pushing over 22 and instead dropping 6.2% and giving up much of the previous day’s gains.

- T2108 (% of stocks trading above their 40-day moving average): Barely any movement in this indicator yesterday which is ultimately what this market did as well.

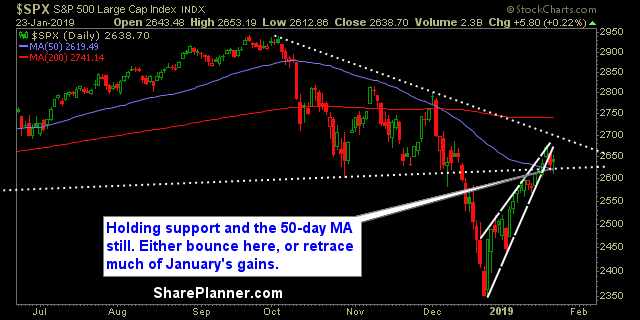

- Moving averages (SPX): Broke below the 5-day moving average while managing to still hold the 10-day and 50-day MA’s.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Your defensive sectors led the way yesterday, which isn’t exactly the lineup you want to see. Financials, Technology, Discretionary, and Industrials all sporting bull flag patterns right now.

My Market Sentiment

The bulls gave up their gains yesterday after a strong open. But instead of seeing a significant pullback, the market seems more content right now with churning price and keeping things choppy.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 20% Long.