My Swing Trading Approach

I added an inverse ETF on the S&P 500 yesterday (SPXU). Slightly underwater, but looking for this market to give back some of these steep gains from the past two weeks. I may add to my position by shorting additional ETFs should a market pullback take hold. Otherwise, I’ll close out the position and flip long.

Indicators

- Volatility Index (VIX) – Another small bounce of 5% on VIX to 19.07. The decline in VIX has been steep of late, and due for a sizable bounce here.

- T2108 (% of stocks trading above their 40-day moving average): No weakness showing up yet on the T2108 here. Holding its recent gains very well, and still posting a +50% reading.

- Moving averages (SPX): Broke below the 5-day moving average yesterday, but still holding the 10 and 20-day MA.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Financials rallying over 12 of the last 13 trading sessions will face some weakness today following key earnings reports. Healthcare and Utilities are showing some signs of weakness here following yesterday’s trading session, while most of the other sectors are simply bull flagging.

My Market Sentiment

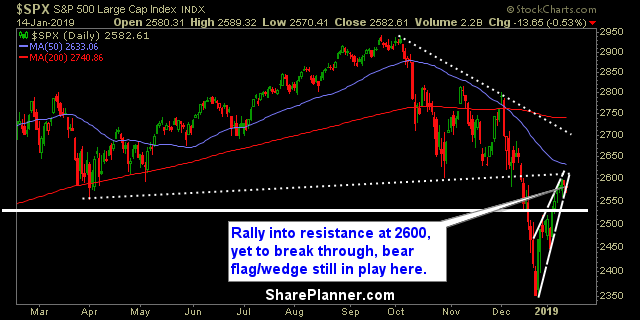

The resiliency of the bulls on this bounce has been impressive. Price action has rallied hard but facing strong resistance at the 2600 area. Also a bear wedge/bear flag in play too. A solid push through 2600 would confirm the continuation of this market rally.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 10% short.