My Swing Trading Approach

I added two new trades on Friday, and will look to add another 1-2 more today should the market show signs it wants to add to the gains. Never trust this market. Volatility swings are wild, and you should expect a change of direction at any moment.

Indicators

- Volatility Index (VIX) – Down 6 of the last 7 trading sessions and now looking a a potential move below 20. Currently sitting at 21.38.

- T2108 (% of stocks trading above their 40-day moving average): Finally a huge move for this indicator – I was wondering when we would see it. A rare triple-digit move of 108% to push it back to 20% overall. Still plenty of room to run, if this market wants it.

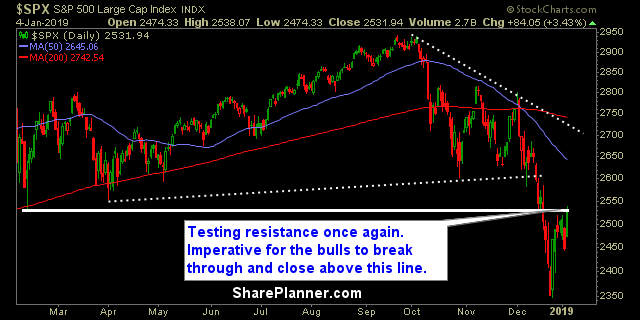

- Moving averages (SPX): Stopped just short of breaking the 20-day moving average, which will be in play today. Crossed back above the 5 and 10-day moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Everything was solid on Friday, every sector showed a good deal of strength, with Technology and Materials leading the way with moves of over 4%. Energy also rebounded which was hugely important to this market’s health going forward.

My Market Sentiment

Re-testing critical resistance overhead. Closed right on it following Friday’s huge rally. Needs to break above it today. Oversold conditions are starting to lift for this market and that’s a good thing as well, because it shows, buyers are finally starting to get interested in making a move in this market.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 20% long.