My Swing Trading Approach

I played SPXU twice on Friday. I closed it out early on when it looked like the bulls might try to take the market back up for a +2.8% profit. But shortly later, I re-entered the trade again, and sold it at the end of the day for another +2.9% profit. It has been a fine month of trading for me in the month of December so far…and I’m pretty sure that most traders wouldn’t be able to say the same. With that said, I am coming into today with a 100% cash position. I’ll get long or short depending on how the market fares today, and the conviction/volume that it shows.

Indicators

- Volatility Index (VIX) – Not much volatility on Friday for the amount of selling that we saw. I would have suspected more, and leads me to think this market may try to thwart consensus and bounce at some point.

- T2108 (% of stocks trading above their 40-day moving average): December lows back in play. It sold off 16% on Friday and back into the teens. Single digit reading are usually the prime opportunity to get long equities.

- Moving averages (SPX): Lost the 5-day moving average on Friday, and now trading again below all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

I’ve put together a very extensive post on all the sectors that I recommend you read, by clicking here.

My Market Sentiment

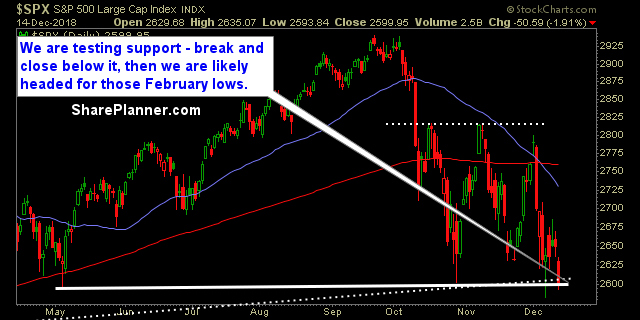

You have a death cross confirmed last week with the 50-200 day-moving average cross over, followed by fresh closing lows that haven’t been seen since April 2nd. Despite the VIX not really rallying that much, this market does not look all that inviting for the bulls right now.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 100% Cash