My Swing Trading Approach

I didn’t add any new positions yesterday, as the market was dull and didn’t afford any real trade setups. I still have SPXU and will look great heading into the open today. If the market can wash out the longs and put in a healthy bottom, I’ll look at closing SPXU and starting some fresh long positions.

Indicators

- Volatility Index (VIX) – Pulled back for a fourth straight day, but the pullback has been controlled and not showing any real interest to the downside. Today’s weakness coming into the day should see a pop of 6-7% initially.

- T2108 (% of stocks trading above their 40-day moving average): Still the bullish divergence considering it hasn’t broken or come close to breaking the October lows, but in recent days, it has shown a willingness to push lower.

- Moving averages (SPX): Closed above the 5-day moving average again, but that is it.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

I’ve put together a very extensive post on all the sectors that I recommend you read, by clicking here.

My Market Sentiment

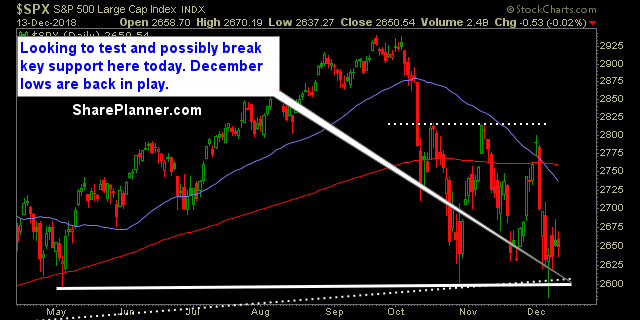

Overnight sell-off and headline risk is back, and the bears are looking at a possible retest again of the December lows. May not happen today, but considering the inability of the bulls the last three days to hold on to any substantial gains, the market is now vulnerable to a resumption of the downtrend.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 1 Short Position