My Swing Trading Approach

I closed out my long position in NFLX for a -0.9% loss on Friday, early in the trading session, and then took a long position in SPXU (short ETF of 3:1 on SPX) for a +3.8% profit. Today, I am entering the day 100% cash, and will watch to see if the early morning strength can hold in the early going before trying to play it long, otherwise, I’ll likely fade the strength.

Indicators

- Volatility Index (VIX) – A 9.6% rally on Friday puts it in a position to test the highs from October.

- T2108 (% of stocks trading above their 40-day moving average): A 20% decline took it down to 25%. Currently the indicator is nowhere near oversold or at extremes – not good for the bulls going forward.

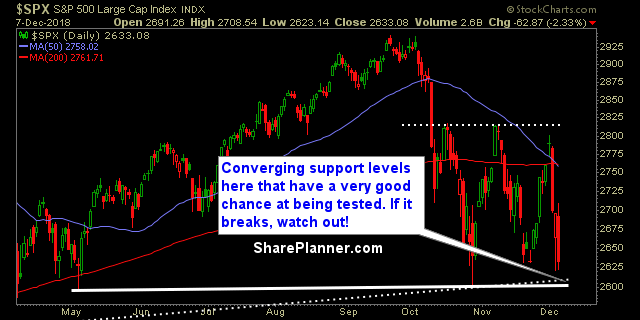

- Moving averages (SPX): Trading below all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Utilities continue to be the safest place to put your money at. A new closing all-time high on Friday. Energy still trying to hold support going back to February. Relative strength on Friday. Financials and Industrials look very troublesome here.

My Market Sentiment

Rising trend-line off of the February lows looks to be tested yet again today. Careful about taking to strong of a bias in any direction. The market is seeing huge swings here. If Thursday’s lows breaks, it is almost certain we see a retest of October lows.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 100% Cash.