My Swing Trading Approach

Profits were taken on Friday as a result of Saturday’s G-20 uncertainty (yes, we could easily have opened up -40 points on SPX if there was an escalating of tensions). In particular, I took profits in NFLX of +6%. I’m open to adding long positions, but I think the market is a bit overzealous this morning at the open, and is susceptible to a sideways or a push lower into today’s gap. Careful here, because max pain for the market today would be profit taking and market fade.

Indicators

- Volatility Index (VIX) – VIX dropped 3.8% and setting up for a move down to the 16’s today and likely to set up a test of support at the November lows. Also, Friday saw its 50-day moving average violated.

- T2108 (% of stocks trading above their 40-day moving average): Another 8% move to 44. I would look for a reading over 50 today, which would be a huge deal for this market. However, overbought conditions here should be a concern.

- Moving averages (SPX): Price closed right at 200-day MA, but look for a push above it and the 50-day moving average to take it above all the major MA’s.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

I put together an intensive sector analysis last last week, and would encourage you to check it out here.

My Market Sentiment

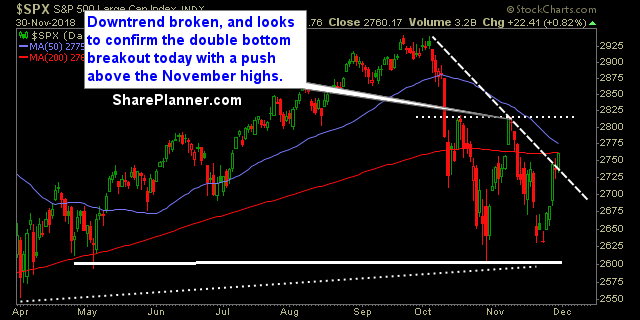

The November highs look like they’ll get tested here right at the open. What makes that so significant is that, if it breaks, and close above those levels, it would setup a double bottom scenario for the market that would likely result in a retest of its all-time highs again in the not-so-distant future.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 100% cash.