My Swing Trading Approach

I took profits in my trade in Visa (V) for a +2.4% profit yesterday, and added another swing-trade later in the day. Holding +7% in profits with Netflix (NFLX). I don’t expect to add anything today ahead of the G20 Summit, but instead will look to add more swing-trades, if the meeting goes well, on Monday.

Indicators

- Volatility Index (VIX) – Up over 10% at one point yesterday, but quickly surrendered its gains for a meager 1.6% rally and continues to hug the 50-day moving average for a second straight day.

- T2108 (% of stocks trading above their 40-day moving average): A 4% decline yesterday, but overall, the bullishness exhibited since the October lows, remains intact. A move over 50% would be very promising for the market going forward.

- Moving averages (SPX): Tested and held the 20-day moving average, but unable to break through the 200-day MA. Expect a 50/200 DMA (death-cross) as early as next week.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

I put together an intensive sector analysis yesterday afternoon, and would encourage you to check it out here.

My Market Sentiment

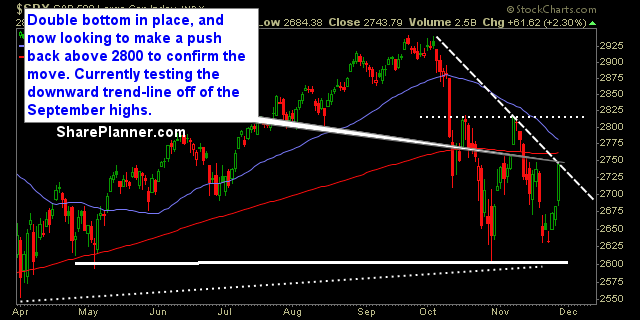

Downward trend-line tested off of the September highs – this needs to break today. The G20 Summit is this weekend, and a meeting with Trump and China over the tariffs will more than likely create a large gap higher or lower Sunday night. Frankly, I think both parties want a deal, but should that not happen, the market will take the brunt of it. There’s no way to know the outcome. The best thing to hope for is that progress is made ahead of the meeting, during the market hours today. I suspect you may see some profit taking later this afternoon, as traders will become nervous about holding positions over the weekend, following a week of substantial gains.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 3 Long Positions