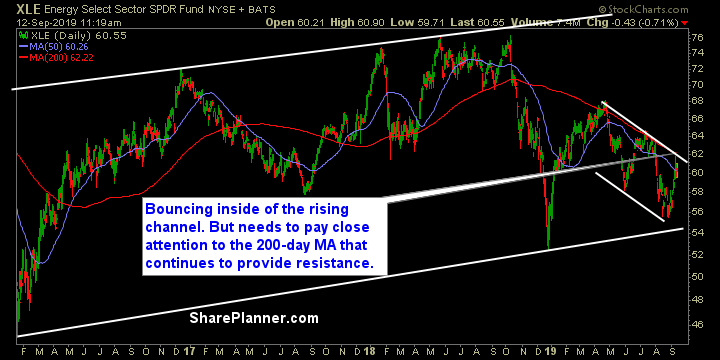

I don’t have any issues with any of the sectors right now except for Energy.

Energy is seriously the most unpredictable and untradeable sector right now. Nothing holds to the upside, and just when you think a stock is breaking out, it reverses course and breaks down on you.

Take Hess (HES) – it only took one trade for me to realize, I wasn’t going to be trading it again anytime soon. Huge resistance level, keeps breaking out above the price level, only to fall right back below it. Been doing it for months. I looked at it last week, and thought the breakout might actually stick…

NOPE!

Stopped out the next day. Had I traded it again, each time would have been the same result.

So avoid the energy stocks – they are fools gold. I’ve placed about 150 trades so far this year and only four of them have been energy related, and of those four, just one has been profitable.

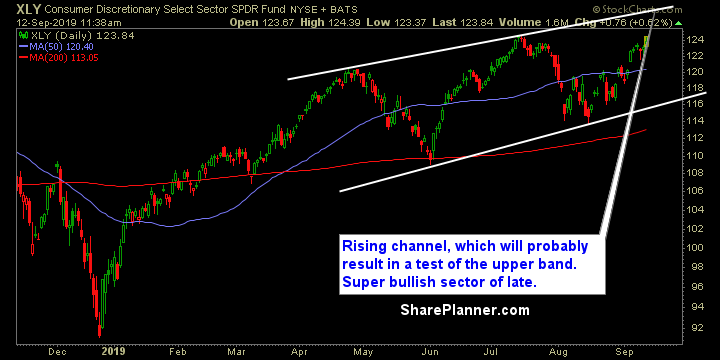

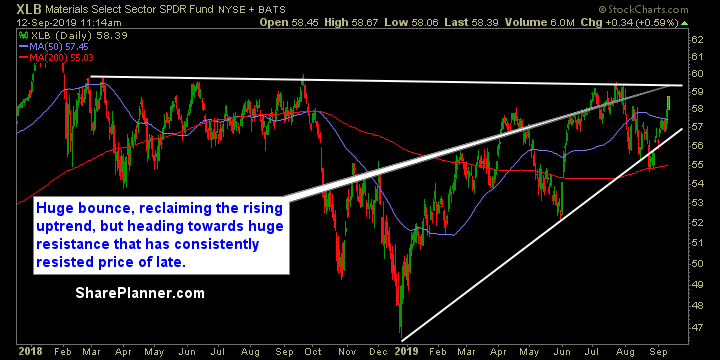

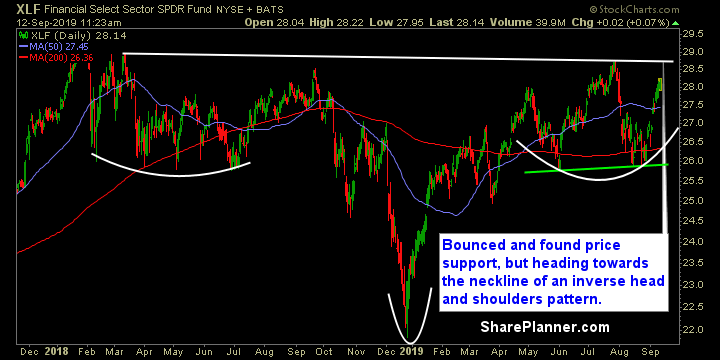

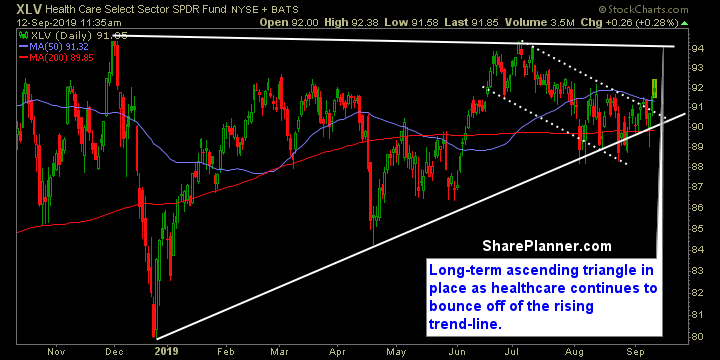

As for the rest of the sectors, trade away. I’m not sure how much upside Materials and Healthcare have left in them, but overall, the defensive stocks as well as the traditional growth ones like Technology and Discretionary have been quite solid.

Here’s what I see as the top 3 sectors right now:

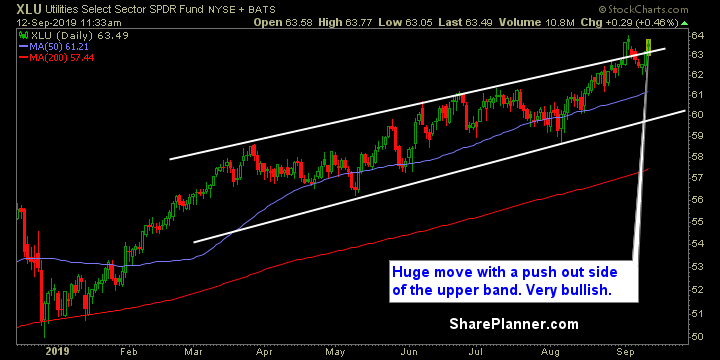

- Utilities

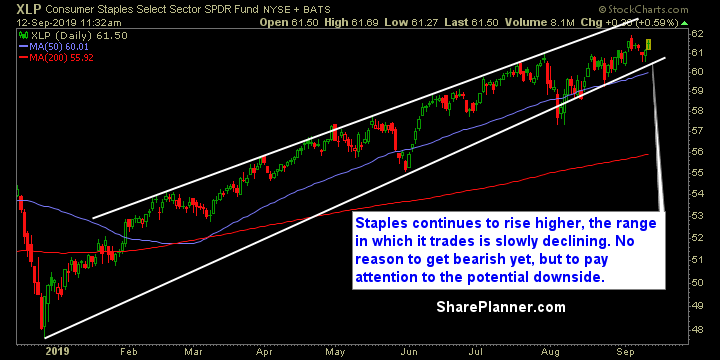

- Staples

- Industrials

The 3 worst sectors are:

- Energy

- Healthcare

- Materials

Let’s review the sectors:

Basic Materials (XLB)

Energy (XLE)

Financials (XLF)

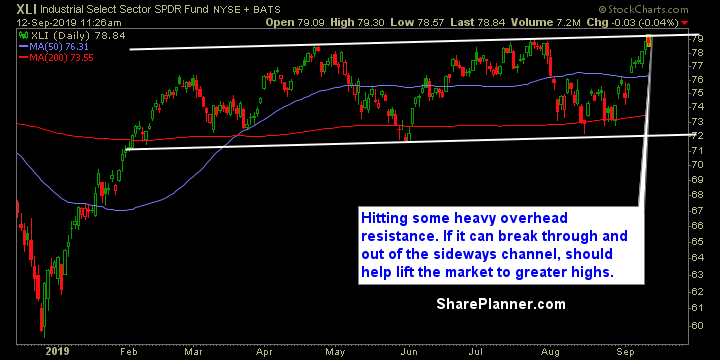

Industrials (XLI)

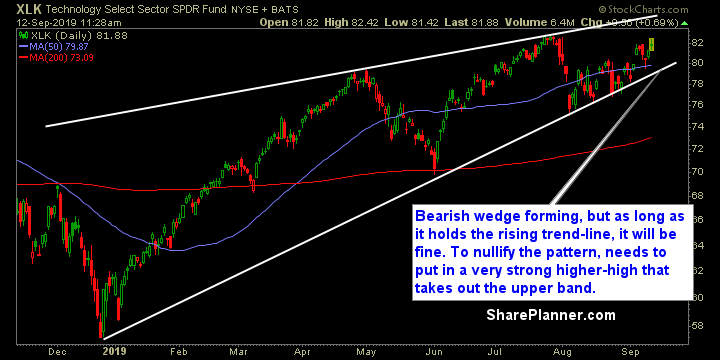

Technology (XLK)

Consumer Staples (XLP)

Utilities (XLU)

Health Care (XLV)

Consumer Disretionary (XLY)