The market is all over the place – just think, last week SPX was on the cusp of possibly dipping below 1800’s and into the 1700’s. In fact, many thought that it would.

But here we are now in the latter parts of October and SPX currently sits at 1954. That is a HUGE reversal and the monthly chart shows it with its insane hammer candle.

I remain skeptical of this market and my exposure to this market shows it. Only 50% of my capital is at work and I won’t hesitate to lessen that if the market suggests doing so.

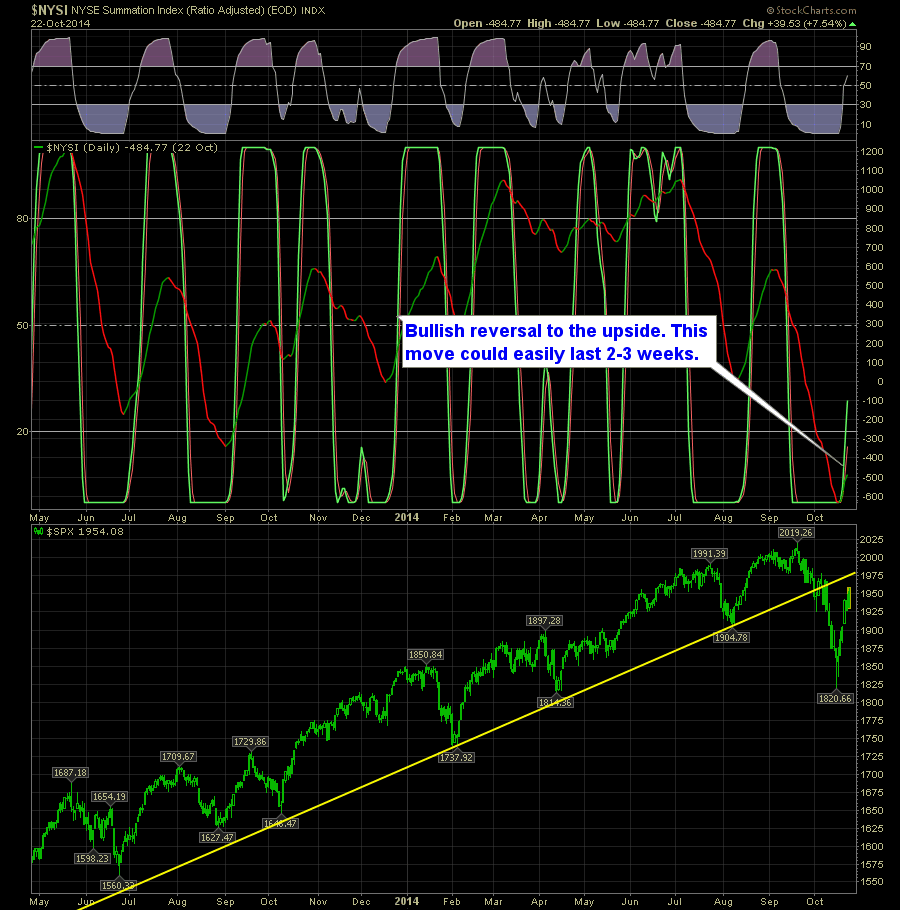

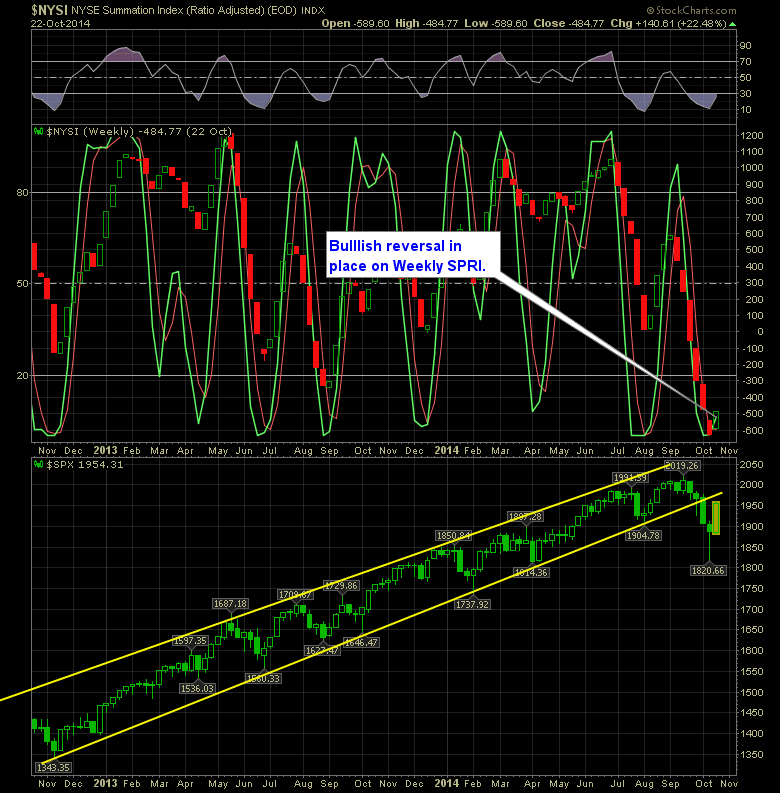

But when you look at the SharePlanner Reversal Indicator on both time frames, the outlook is promising and a reversal is clearly underway here, of which could easily last a few weeks to a couple of months.

Here’s the Daily SPRI:

Here’s the Weekly SPRI:

As you can see the bulls have control of this market. I don’t put it past this market to change that mentality at any time here. But while the market is pushing higher and the SPRI is pushing higher, there is little reason to be net short this market at the moment.