The market is shedding its bullish act, and taking on a much more bearish tone.

Jerome Powell’s circus yesterday, coupled with Trump’s untimely Chinese tariffs tweets today, has instantly put this market into a tale-spin. Short -term support levels are being violated across the board, and traders are being whip-lashed all over the board. The past two days have represent one of the hardest stretches for traders in 2019. It is headline driven off of Tweets and Pressers, and there is literally zero predictability in this market.

The Fed said trade tensions had come back down to a simmer, and today, there’s full scale tariff war. Couple that with July where the market had no interest in really moving whatsoever, and you have a stretch in this market where the opportunities have been limited for traders.

Nonetheless, lets hope we can get an extended period of downside for traders so that profits can be made to the downside via shorting, and then made even more so on the bounce back up to inevitable all-time highs.

Here’s what I see as the top 3 sectors right now:

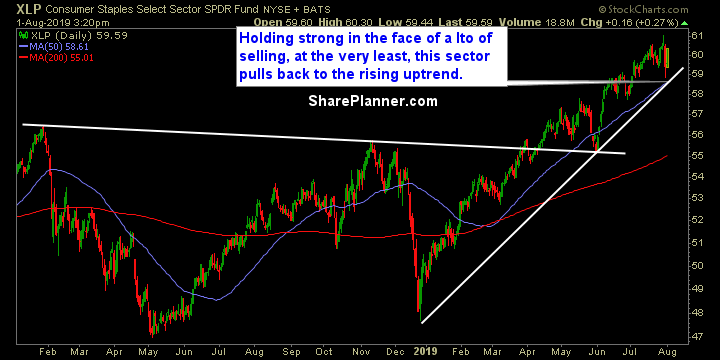

- Staples

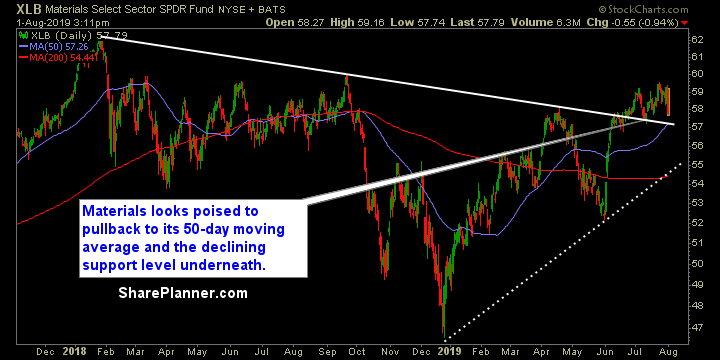

- Materials

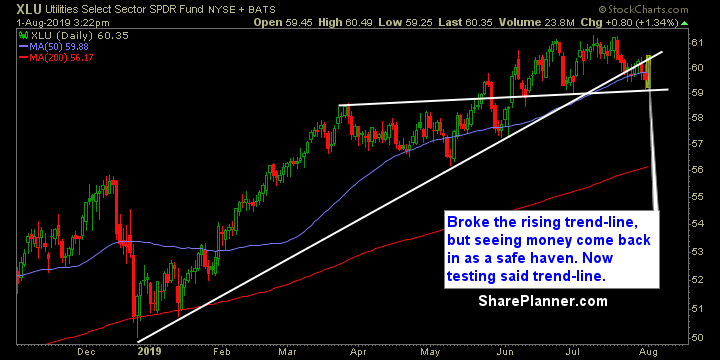

- Utilities

The 3 worst sectors are:

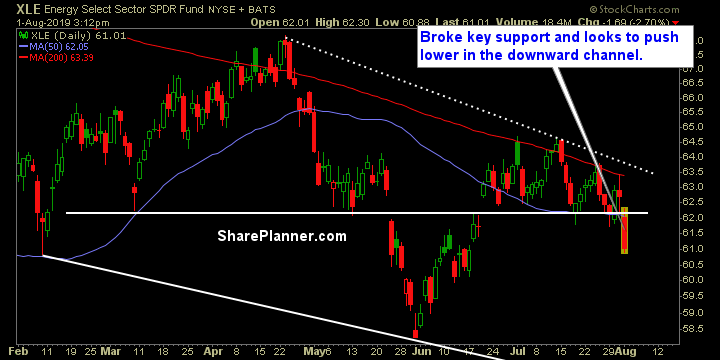

- Energy

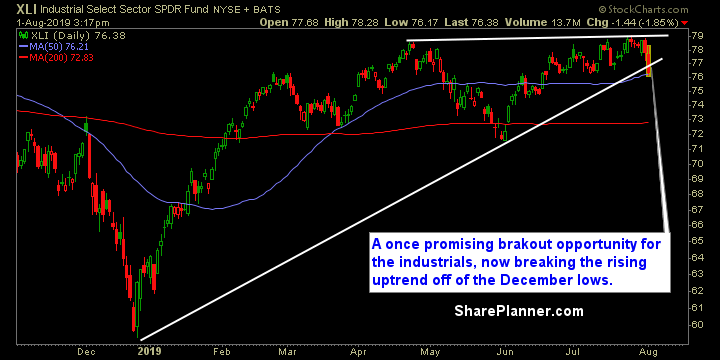

- Industrials

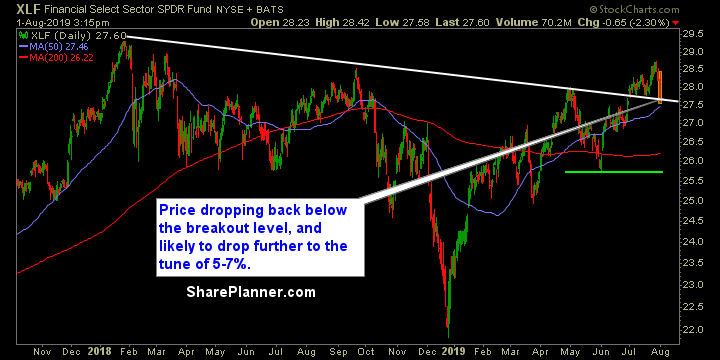

- Financials

Let’s review the sectors:

Basic Materials (XLB)

Energy (XLE)

Financials (XLF)

Industrials (XLI)

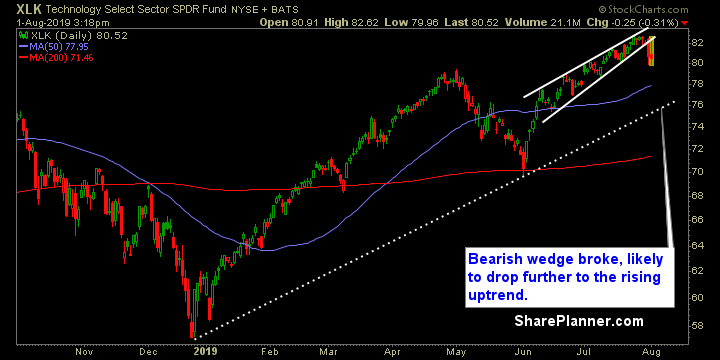

Technology (XLK)

Consumer Staples (XLP)

Utilities (XLU)

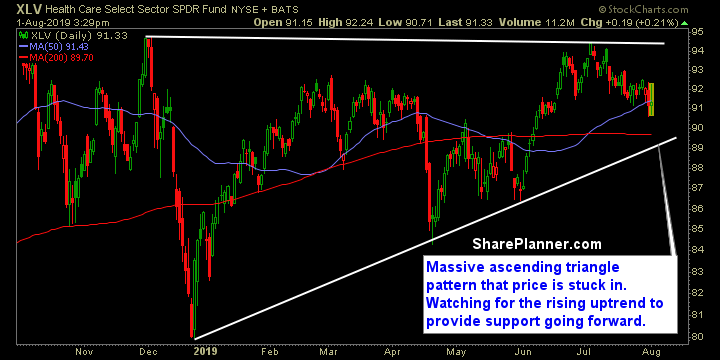

Health Care (XLV)

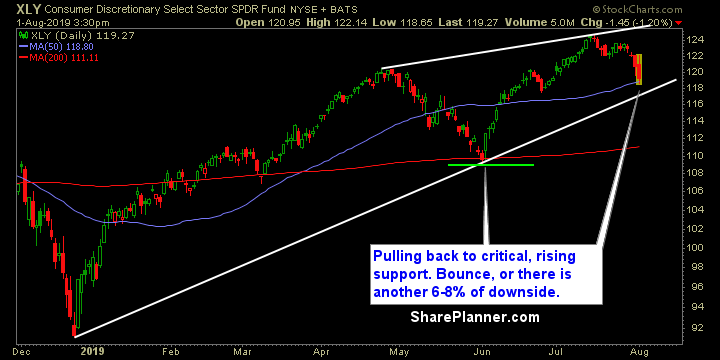

Consumer Disretionary (XLY)