A lot of varying patterns among the sectors, but mostly bullish

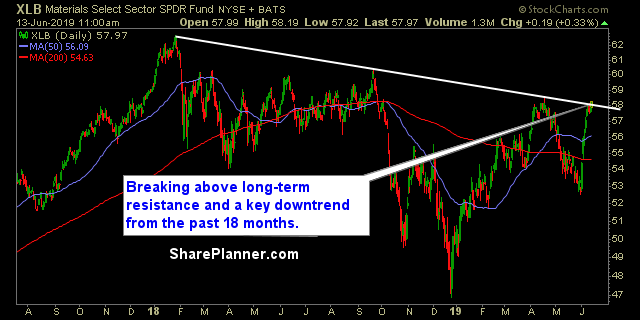

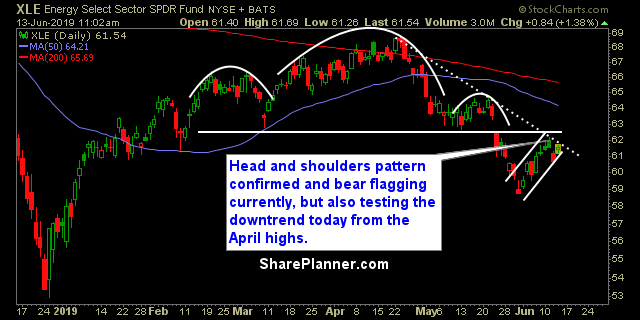

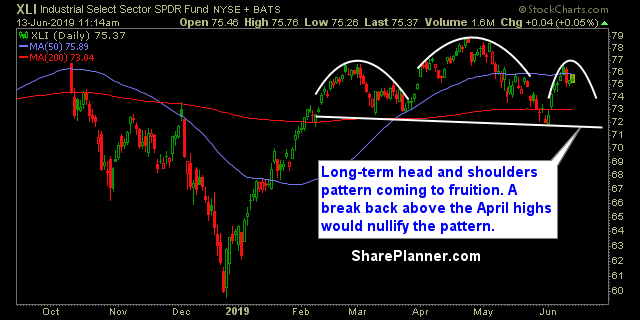

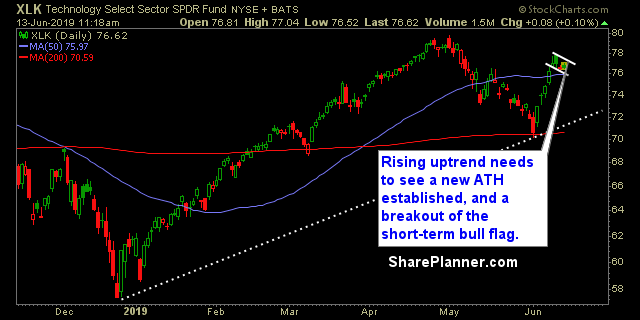

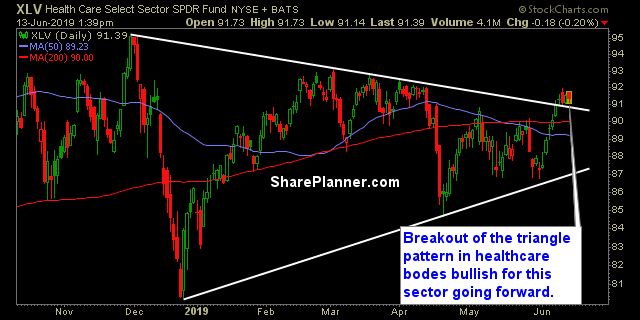

May was not kind for the market. June has been much better for the bulls, and last week’s bounce put SPX back to about 2% below all-time highs. There are triangle patterns (healthcare), head and shoulders patterns (energy), bull flags (technology), and downtrend breaks (materials), just to name a few. Needless to say, there’s a lot going on across all the sectors, mostly bullish, but some repairs that still need to be done in order to fix the damage from May.

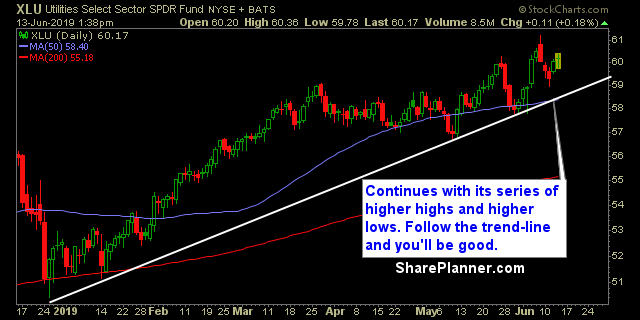

Overall, your top two sectors are your safer ones, as money is still flowing into them as safe havens, but then you have technology as the third best sector, and materials closely behind. Don’t be too aggressive with this market, but when you find some plays that make sense, don’t be afraid to pull the trigger on them.

Here’s what I see as the top 3 sectors right now:

- Staples

- Utilities

- Technology

The 3 worst sectors are:

- Energy

- Industrials

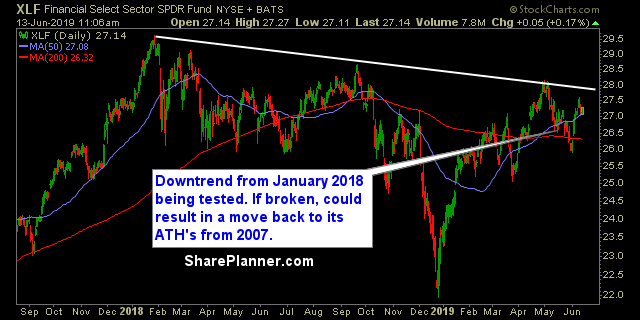

- Financials

Let’s review the sectors:

Basic Materials (XLB)

Energy (XLE)

Financials (XLF)

Industrials (XLI)

Technology (XLK)

Consumer Staples (XLP)

Utilities (XLU)

Health Care (XLV)

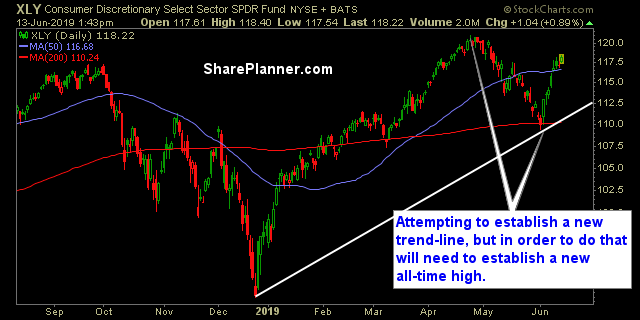

Consumer Disretionary (XLY)