Early reversal on the indicator has the bulls feeling optimistic for all-time highs.

I’ll admit though, if we have to deal with this kind of chop fest on our way to all-time highs, it isn’t going to be a very fun experience that’ll be for sure. Money is rotating in and out of sectors and industries each and every day, and rarely do you find a stock that can provide a few days of consistent gains.

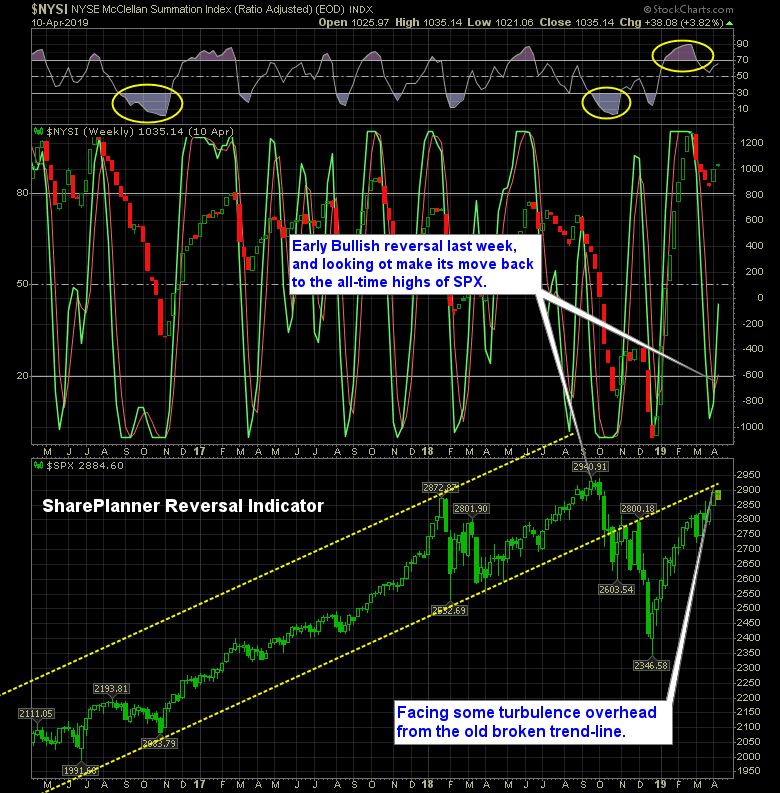

Last week the bullish indicator reversed much earlier than anything I have seen over the last few years, and my interpretation of it is that we are likely to make a run for those all-time highs in the very near future.

Here’s the SharePlanner Reversal Indicator:

T2108 Indicator:

There’s still room for this market to run as the T2108 Indicator (The percentage of stock trading above their 40-day moving average) has been diverging for much of the past two months, which means stocks aren’t quite as bullish as the indices would portray them as being, which also means that stocks are not really overbought at this point either – so once again, there is some room to run for the bulls.