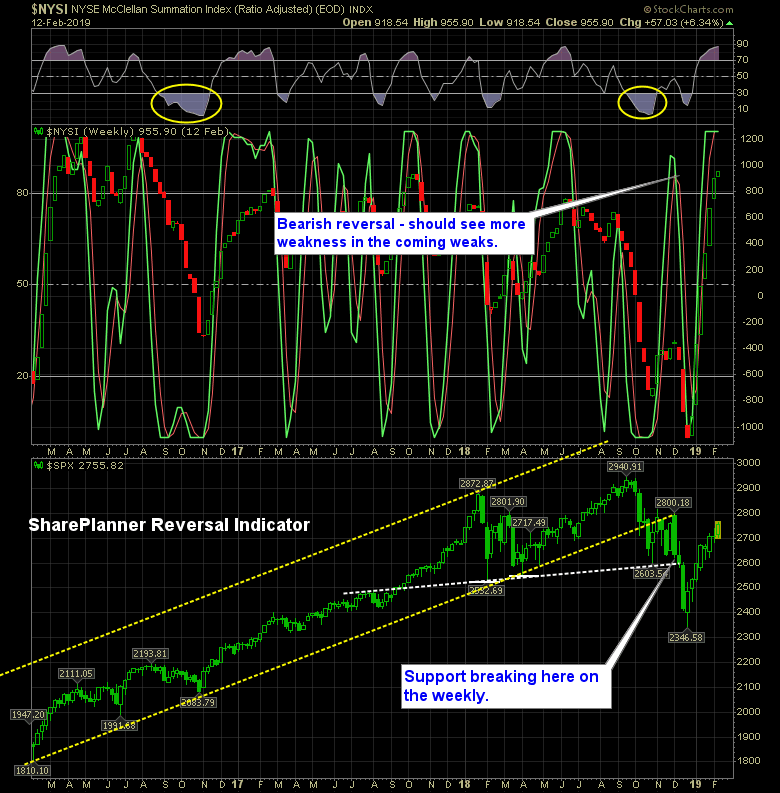

Equities are overbought and the Reversal Indicator Agrees

We’ve seen for the past 10 years how a market can get overbought and stay overbought for a very long time, and for the past couple of weeks, the market has been extremely overbought, and there are signs that the buying is exasperated as indicated by the lack of volume and across the board.

Sure it has its moments, as we saw yesterday, where we get a huge move off of positive news, but those moves, in general, become much less in frequency then what we saw in the beginning of last month, when it was rallying non-stop.

For now, I wouldn’t say get heavily short here. A little exposure isn’t a bad thing, but I still think you want to remain net long on this market here. We aren’t seeing any real sense of panic or a willingness to reverse recent price action and until that happens, I think staying long is the best pat to profits.

Here’s the SharePlanner Reversal Indicator: