Pre-market update (updated 8:30am eastern):

- European markets are trading mixed/flat.

- Asian markets finished 0.3% higher.

- US futures are slightly higher ahead of the bell.

Economic reports due out (all times are eastern): MBA Purchase Applications (7am), GDP (8:30am), Corporate Profits (8:30am), Pending Home Sales Index (10am), EIA Petroleum Status Report (10:30am), Beige Book (2pm)

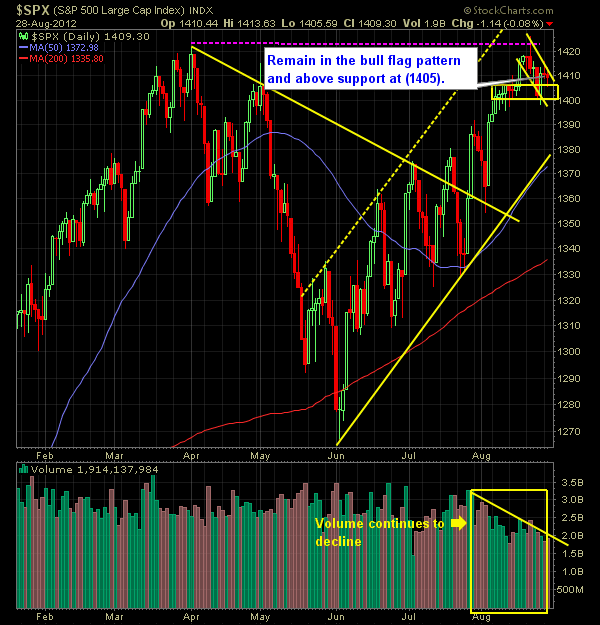

Technical Outlook (SPX):

- Another day of consolidation for the markets, like we’ve seen over the past few days.

- No apparent strong-handedness by the bears despite the opportunity being there for the taking.

- One could make the argument that the price action since breaking the 1422 highs intraday, has been the result of a bull-flag on the daily.

- 30-min chart on SPX shows a well established bullish trend over the past month. Action since 8/21 has the potential for a new channel downward possibly forming.

- If we sell-off again today, watch the 20-day moving average to act as a possible support level for the market, in which bulls try to buy the dip at.

- 10-day moving average has been rather useless of late, largely going ignored by the indices.

- Going forward SPX needs to close above 1422 and take out 1426 recent intraday highs.

- Volume remains at ridiculously low levels – Monday was no better.

- We are well-off of overbought levels – which gives this market plenty of room to run.

- SharePlanner Reversal Indicator received a bullish confirmation signal.

- VIX continues to climb – up 6 out of the last 7 days and at +16.

- One area of concern is the 3 large gaps off of the 6/4 lows that remain unfilled, including 6/6, 7/26, 8/3

- If another sell-off were to ensue, watch for a break and close below 1354 for a new lower-low in the market.

My Opinions & Trades:

- No new positions for me yesterday.

- Closed RNDY yesterday at 7.70 from $7.86 for a -2% loss

- Any new long positions will likely result in me closing out an existing long position.

- Current stop-losses have been adjusted across the board.

- Stop-loss in AMZN moved up to $241.00.

- HE Short stop-loss has been has been tightened to 27.40.

- ALXN stop-loss moved up to $100.98

- Remain long RHT at $57.56, CRM at $145.39, FBHS at $24.54, ALXN at $102.53, LXP at $9.21, and AMZN at $233.90. Short HE at $28.45.

- Track my portfolio RealTime here.

Charts:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.