It was another great swing trading performance in the stock market for members of the Splash Zone

As you know by now, I am a huge proponent about swing trading transparency when it comes to my stock market performance. There are so few traders out there that actually show their results, much less go to the lengths I do to show the good and bad of my trading.

Simply put, I want to be a person that you can trust, when it comes to the financial markets, and the only way I can do that is by being honest with myself when it comes to how I trade and how well I perform in all matters related to the stock market. And then I get to humble myself some, and share it all with you.

These are the trades that I make, I’m not diddle-daddling in other trades, all the swing trades that I make are the ones that are listed here in my past-performance, and nothing more.

So let’s get to it shall we?

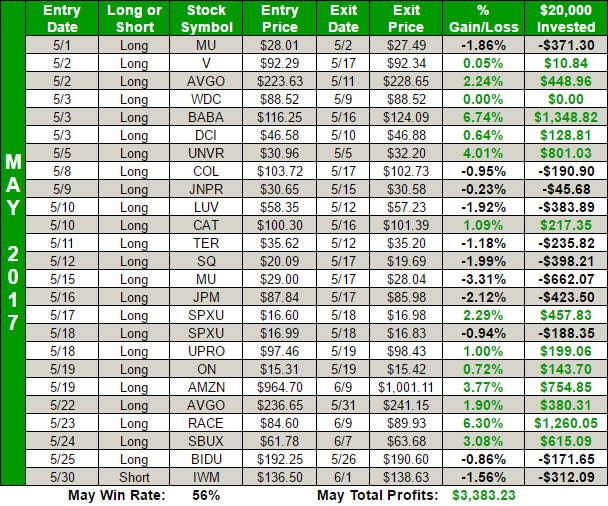

Here’s my swing-trading performance in the stock market for May

I’ve closed out all of my positions from this month and nothing remains open from May. So all the results are final. By far my favorite trade was in Ferrari (RACE). It probably had something to do with the fact that I was trading Ferrari’s stock for the first time ever, and the fact that it was a nice profitable trade for me as well. I had stalked this trade for months, and a couple of times I passed up on it (and later regretted it) but it finally came around again and gave me another great opportunity and this time I took it, getting in at $84.60 and selling it a few weeks later at $89.93 for a 6.3% profit.

But that wasn’t the only trade, obviously, so let’s take a macro look at the rest of them.

Here’s the breakdown:

-

I was profitable on 14 out 25 (56%) of my trades.

-

13 out of 22 (59%) trades were profitable that were focused on bullish/long setups.

-

1 out of 3 (33%) trades were profitable that were focused on bearish/short setups.

-

2 out of 4 (50%) trades were profitable using exchange traded funds (ETFs).

-

12 out of 21 (57%) trades were profitable that were equities.

Obviously there were 1) much greater emphasis placed on the long side than the short side and 2) much greater focus on equities versus ETFs.

That is not because I favor one side of the trade versus the other but I do favor individual stocks more so than ETFs, but market conditions can influence the balance between the two.

When it comes to going long or getting short, the bias is absolutely influenced by market conditions. This is one of the hardest markets you can possibly short, not because the market is flying higher, because it really has’t over the last three months. Instead it is more about choppiness and quick dips that get bought up before things can get out of hand.

Where the biggest of frustration for me came from was the May 17th sell-off that sent the Dow down 373 points on the leak of the Comey memos and talk of obstruction of justice by Trump regarding the Michael Flynn matter.

But out of that horrid sell-off, that came, following the day before, where the market had made new all-time highs, resulted in the best buying opportunity that the month had to offer – some real price movement out of all the indices. Heck, it even woke up the Russell 2000 as it managed to bounce as well.

So here was what was key to my trading that month and my stock market performance:

When the market sold off on May 17th, it looked as if the stock market had peaked and was ready to turn lower. The talking heads of the mainstream media were begging for it. The price action on the S&P 500 even broke through the 50-day moving average – that was big. Everything looked ugly on the charts!

BUT…

As has been the case going back to last year’s Brexit, the major sell-offs don’t last more than 1-2 days and in the case even more recently, it has only been a day…if that!

So on May 18th when the market sold off initially at the open and started to rally again, I had to cover my short position and get out while I could and get long again and I did exactly that with UPRO – the 3x ETF (which I probably shouldn’t have sold so soon), followed by trades in Amazon (AMZN), Broadcom (AVGO), Ferrari (RACE) and Starbucks (SBUX) – all of which yielded nice profitable returns of 3.8%, 2%, 6.3% and 3.1% respectively.

I definitely took a hit on May 17th, but I always remained profitable – and that, my friends, is the key to successful trading.

I was stopped out of a number of my positions that day, but as has been the case all year long, I don’t take huge losses, and I always make sure to walk away with a majority of my profits by consistently and regularly moving up my stop-losses. Because the sell-off was off of a freak news event, that no one saw coming and it rattled the markets like no one foresaw.

And that is why I use STOP LOSSES

You are able to preserve yourself. You keep small losses from turning into big losses, and profitable trades from turning into losing trades.

My biggest regret of the month will ultimately be getting stopped out of Square (SQ) for a 2% loss. Because very soon thereafter the stock went on a major tear.

But that is one of the downfalls of stop-losses; sometimes you get stopped out only to see the stock turnaround for a big move higher. But the benefits of using stops will always outweigh those negatives.

Look no further than Starbucks!

It was a beautiful set up in SBUX – essentially a double bottom breakout play that confirmed on the day that I got in, which was the 24th. It went up six out of the next seven days, and the one day it finished down, it was hardly even a sell-off.

Along the way I moved up my stop loss on the trade – all the way up to $63.68, which it eventually tagged and I walked away with a nice 3.1% profit.

Then the next nine days it did nothing but sell-off. By using stop-losses, I took the large majority of my profits. And I couldn’t be more happy about it. Had I simply just relied on blind hope, and ignored the use of stop losses, it would have resulted in a loss of over 3% and a difference from where I got out at to where it went down to of over 6%.

So yes, stop-losses work and they keep you profitable when used right. But to not use them is simply begging the market to take your money. For a while it might work, but eventually it is going to burn you and burn you bad.

What worked for me and my swing-trading

As was the case there were some industries that were worth trading and other that were to be avoided at all costs.

For the ones that provided the best return, they were:

-

Non-traditional retail

-

Tech in general

-

Non-traditional auto stocks (i.e. Tesla and Ferrari)

Those industries I wish I would have avoided or actually did avoid:

-

Financials – namely the banks

-

All the semis minus AVGO

-

Everything Oil

The semiconductor plays like Micron (MU) x2 and Teradyne (TER) made it where I would have preferred to have sat out of the the semi plays altogether, but then I had two solid trades in AVGO – so in a sense it was really hit or miss.

RELATED: My Swing Trading Profits in April

The banks and oil – two sectors that I am glad I didn’t put much capital to work in were a disaster to work with. Trading patterns didn’t play out well, and just when you thought that they might be turning the corner they puked all over themselves. This pattern has only worsened in the month of June too. I’m choosing to stay away from them for the time being.

Why is that you ask? Because I care too much about my capital not too!

Overall, it was a good month for me in the stock market and my swing-trading performance shows it.

My winning percentage for the month was in line with my historical winning percentage, though I am always “game” for anything higher. And while I am more than satisfied with the returns, there is that gnawing tendency among successful traders, to never be completely at peace and think about the areas that I could have been better in.

The massive sell-off that came out of right field was undoubtedly a bummer, but how I reacted to it and the management of each trade was spot-on and had that sell-off not taken place, it might not have given us that absolutely splendid rally into the close that allowed for me to rack up some awesome winning trades.

As I am writing this, we are heading into the final week of June (I know, I was a little late in getting my May review out) and members of the Splash Zone are poised for another fine month of gains. I would encourage you to join me and the rest of the Splash Zone traders before July comes and goes and you miss out on even more profits.

With your membership to the Splash Zone you get all my swing-trade alerts via text, email and in the chat room too, and anytime I make a move, update a stop or book a gain, you’ll be notified in real-time. So check it out and join the profit train with a Free 7-Day Trial and start booking those profits today.